Citigroup plans to launch crypto custody providers in 2026, after creating the providing for 2 to 3 years, in line with world head of partnerships and innovation Biswarup Chatterjee, who instructed CNBC.

The financial institution is exploring each in-house know-how options and potential third-party partnerships, with Chatterjee stating “we’re hoping that within the subsequent few quarters, we are able to come to market with a reputable custody answer” for asset managers and different purchasers.

Wall Avenue Coming to Crypto? Citi Mentioned Sure

The upcoming service would contain Citi holding native cryptocurrencies on behalf of purchasers.

Chatterjee stated the financial institution could deploy completely in-house designed options for sure property and shopper segments, whereas utilizing third-party light-weight options for different asset varieties.

The financial institution is “not presently ruling out something” relating to its custody technique.

Citi’s transfer contrasts with JPMorgan’s stance, which is that whereas its financial institution will permit purchasers to purchase cryptocurrencies, it won’t but maintain custody of the property.

JUST IN: JPMorgan confirms on CNBC that they may permit purchasers to commerce #Bitcoin and crypto however not but launch custody providers

pic.twitter.com/N2oYWPwwhL

— Bitcoin Journal (@BitcoinMagazine) October 13, 2025

Nonetheless, JPMorgan has additionally expressed curiosity in altering that subsequent 12 months.

The custody plans construct on Citi’s broader digital asset ambitions introduced all through 2025.

CEO Jane Fraser confirmed in July that Citi is “trying on the issuance of a Citi stablecoin” whereas creating tokenized deposit providers for company purchasers looking for 24/7 settlement capabilities.

The financial institution already gives blockchain-based greenback transfers between New York, London, and Hong Kong places of work, working across the clock.

Chatterjee stated discussions with purchasers are underway to determine use instances for sending stablecoins between accounts or immediately changing them into {dollars} for funds.

Wall Avenue Consortium Eyes G7 Stablecoin as Competitors Intensifies

Earlier this month, 9 world banking giants, together with Goldman Sachs, Deutsche Financial institution, Financial institution of America, Banco Santander, BNP Paribas, Citigroup, MUFG Financial institution, TD Financial institution Group, and UBS, introduced plans to develop a collectively backed stablecoin targeted on G7 currencies.

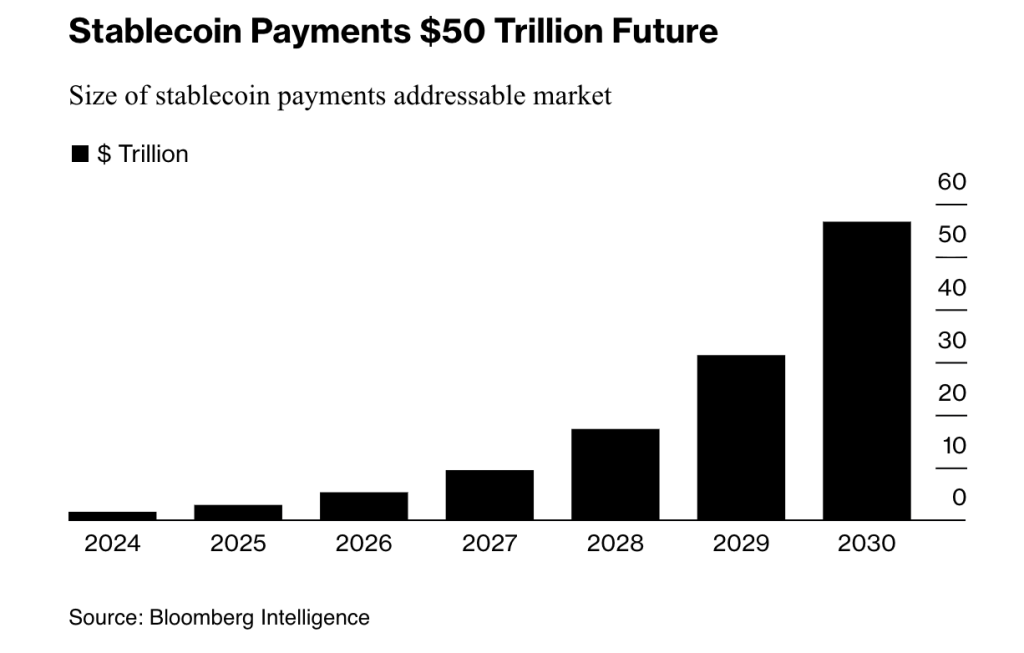

9 banks, together with Goldman Sachs and Citigroup, unite to launch G7-backed stablecoin as market may hit $50T in funds by 2030 and $1.2T by 2028.#Banks #Stablecoinhttps://t.co/oqPhgT5v9w

— Cryptonews.com (@cryptonews) October 10, 2025

The consortium will discover issuing reserve-backed digital fee property out there on public blockchains, with every unit pegged one-to-one in opposition to conventional fiat foreign money.

The coalition confirmed it’s already involved with regulators throughout related markets.

Notably, earlier this 12 months, JPMorgan, Financial institution of America, Citigroup, and Wells Fargo reportedly held exploratory discussions about this shared stablecoin enterprise. Nonetheless, these talks remained conceptual till the affirmation this month.

The banking giants are speeding in because the enterprise mannequin is proving terribly profitable for current issuers who earn substantial yields on Treasury securities and money equivalents backing their tokens.

Given this adoption trajectory, Bloomberg Intelligence initiatives stablecoins may course of greater than $50 trillion in annual funds by 2030.

Nonetheless, whereas banks appear geared in direction of adoption, it may additionally be out of, as Commonplace Chartered warned earlier this month that stablecoin adoption may drain greater than $1 trillion from rising market banks by 2028.

The menace prompted the Financial institution of England to initially suggest possession caps between £10,000 and £20,000 for retail clients.

Nonetheless, following criticism, regulators are actually making ready to permit exemptions for companies like crypto exchanges, which require giant holdings for liquidity and settlement functions.

Citi Balances Stablecoin Alternatives In opposition to Deposit Flight Fears

Citi’s aggressive digital asset enlargement comes regardless of warnings from its personal analyst Ronit Ghose, who cautioned in August that stablecoin curiosity funds may set off Nineteen Eighties-style deposit flight from conventional banks.

Ghose drew parallels to when cash market funds skyrocketed from $4 billion to $235 billion in seven years, draining deposits from banks whose charges had been tightly regulated.

Between 1981 and 1982, withdrawals exceeded new deposits by $32 billion as customers chased increased returns.

Main U.S. banking teams, together with the American Bankers Affiliation and the Financial institution Coverage Institute, urged Congress to shut what they known as a “loophole” within the GENIUS Act, which permits crypto exchanges and affiliated companies to supply yields on third-party stablecoins.

The teams cited Treasury estimates that yield-bearing stablecoins may set off as much as $6.6 trillion in deposit outflows, basically altering how banks fund loans and handle liquidity.

Nonetheless, crypto trade teams pushed again, with Coinbase Chief Authorized Officer Paul Grewal dismissing the banking foyer’s efforts as an “unrestrained effort to keep away from competitors.“

This was no loophole and you already know it. 376 Democrats and Republicans within the Home and Senate rejected your unrestrained effort to keep away from competitors. So did one President. It's time to maneuver on. https://t.co/CGCGxDqKNa

— paulgrewal.eth (@iampaulgrewal) August 13, 2025

Coinbase Analysis notably launched a devoted report back to the “banking menace” narrative, claiming it discovered no significant correlation between stablecoin adoption and deposit flight for neighborhood banks over the previous 5 years.

For Citit, Fraser framed their method as responding to shopper wants and the broader shift towards always-on instantaneous settlement, stating that “digital property are the subsequent evolution within the broader digitization of funds, financing, and liquidity.”

With $2.57 trillion in property underneath custody, Citi’s 2026 launch will be the starting of a strategic adoption of crypto on Wall Avenue.

The submit Citibank to Launch Crypto Custody Providers in 2026 After 3 Years of Preparation appeared first on Cryptonews.