Russia’s Central Financial institution desires to make use of tokenization options to grant international patrons entry to shares in home firms.

The Russian media outlet RBC reported that home business insiders say the blockchain-powered answer could be “possible and engaging to international buyers.”

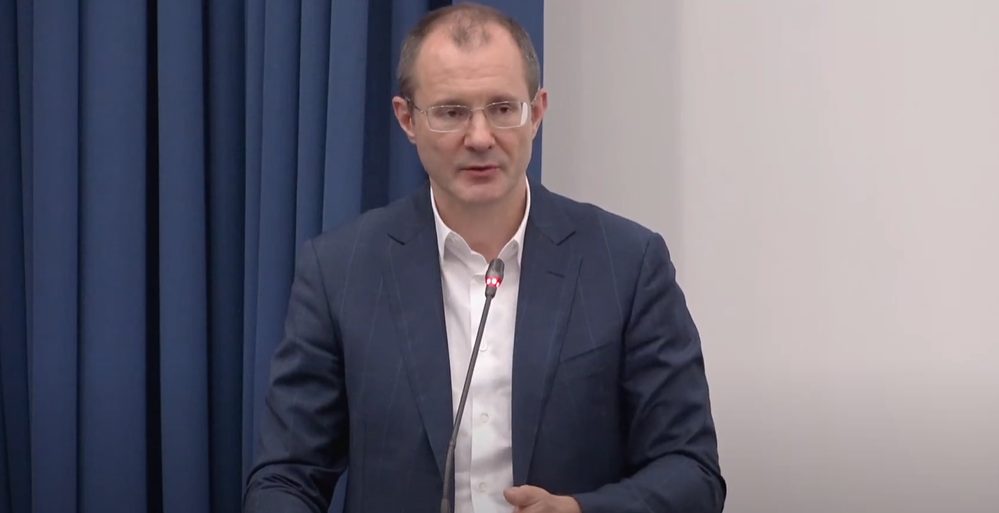

Vladimir Chistyukhin, the First Deputy Chairman of the Central Financial institution, spoke concerning the matter on the sidelines of a current monetary discussion board.

When requested concerning the tokenization of Russian shares, the Central Financial institution government responded with a constructive response, calling it a “attainable possibility.”

Russia’s Central Financial institution: Tokenization May Assist Companies Evade Sanctions

Nevertheless, Chistyukhin instructed that abroad gamers would wish to supply technical and platform-based options. He mentioned:

“On this space, international companions will probably be taking part in a major position. I’m speaking concerning the international entities who’re keen to tokenize Russian property to be able to purchase and promote them overseas.”

Chistyukhin’s feedback come sizzling on the heels of a proposal from Sergei Shvetsov, the top of the Moscow Change’s Supervisory Board.

In late September this 12 months, Shvetsov mentioned that abroad buyers need to purchase Russian shares. And he mentioned that tokenization would assist them achieve this, as the answer doesn’t make use of “sanctioned infrastructure.”

Shvetsov went on to clarify that decision-makers in Moscow have been brazenly speaking concerning the tokenization of Russian shares.

The alternate seems to consider that conventional finance-powered options have a tendency to utilize “sanctioned infrastructure and sanctioned intermediaries and brokers.”

These, he mentioned, had been “sadly widespread in Russia at the moment.” Tokenization, he added, was one among a number of attainable workarounds into account.

Russian Consultants Again Plans

RBC quoted an official from the Russian banking group Sovcombank as voicing assist for the plan.

The Sovcombank official mentioned that tokenization “may develop into an acceptable instrument for buyers” from buyers in BRICS nations or “pleasant jurisdictions just like the UAE, Kazakhstan, or Armenia.”

In the long run, the official added, tokenization may “speed up the Russian market’s integration into the worldwide digital monetary system.”

Alexey Korolenko, the Govt Director of Cifra Markets, concurred. He mentioned that tokenization would enable merchants with restricted capital to purchase fractions of shares with a excessive market worth per share.

Korolenko added that the real-world property (RWAs) sector is now going “mainstream,” and is now “in excessive demand amongst buyers.”

He concluded that the thought of tokenizing Russian shares was “totally possible.” However Korolenko warned that Moscow should be sure that suppliers meet reliability necessities “for your complete possession and tokenization chain.”

Consultants additionally mentioned regulators would wish to think about infrastructure and liquidity issues, in addition to attainable “political dangers.”

The submit Russia’s Central Financial institution: Tokenization Will Let Foreigners Purchase Home Shares appeared first on Cryptonews.