The occasions that transpired prior to now day or so should not uncommon within the ever-volatile cryptocurrency market, however they have a tendency to hurt sure merchants greater than others. Whereas many felt the ache of being liquidated, others appear to revenue.

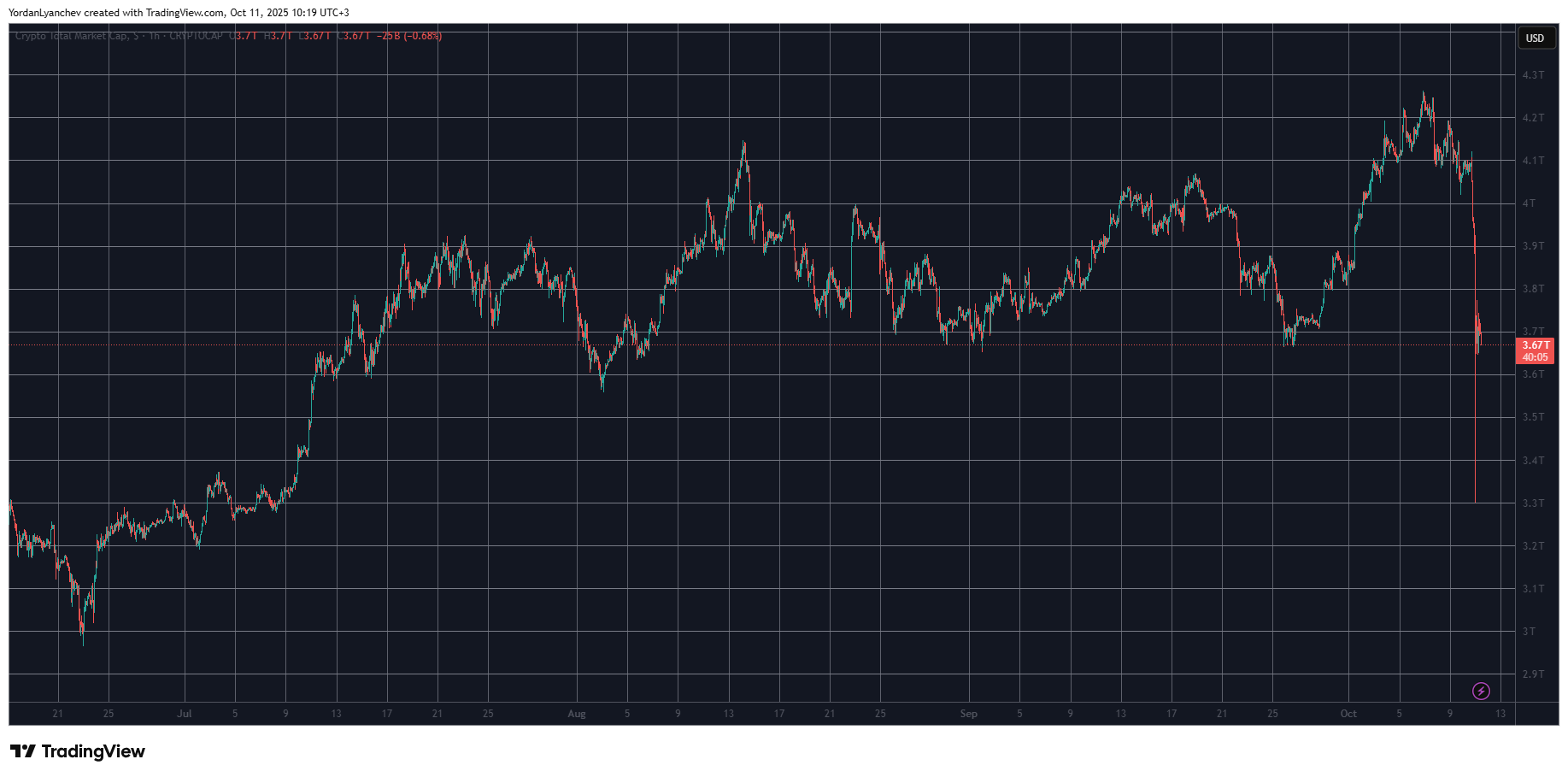

Within the span of simply 12 hours or so, the complete market went from a capitalization price $4.120 trillion on TradingView to $3.3 trillion, which meant a wipe-out of virtually $900 billion. This pushed the metric all the way down to its lowest ranges since July, erasing months of positive factors, earlier than it recovered to $3.670 trillion as of press time.

What We Know

Every time such crashes happen, the cryptocurrency group rushes to supply totally different views on the matter, making an attempt to elucidate what occurred and supply some insights on what may observe. The present collapse isn’t any totally different, as Crypto X is stuffed with numerous opinions and speculations on the matter, particularly because it grew to become the single-largest liquidation occasion within the digital asset market.

Probably the most talked-about purpose is, shock, shock, US President Donald Trump. In what felt like a deja vu, the POTUS alleged China of deception in sure areas and threatened to impose a brand new set of tariffs on Friday, which triggered the primary wave of market-wide declines. He made it official just a few hours later, confirming that these tariffs will start on November 1.

The Kobeissi Letter, although, indicated that markets had been “LOOKING” for a very good purpose to right, given the huge quantity of leverage, particularly in crypto.

The blatant actuality:

Heading into President Trump’s 100% China tariff announcement, markets had been LOOKING for a catalyst to tug again on.

Leverage was by way of the roof and we had not seen a 2%+ decline within the S&P 500 for six months.

President Trump’s put up grew to become THE REASON to…

— The Kobeissi Letter (@KobeissiLetter) October 11, 2025

Bull Concept alleged that certainly one of Bitcoin’s oldest wallets might need recognized what was about to occur as they opened massive quick positions on BTC and ETH a day earlier than the announcement and doubled down as occasions began to unfold. They closed all shorts with a revenue of roughly $200 million in only a day.

Bull Concept added that this wasn’t a retail-driven dump, because it has been on some events prior to now. As a substitute, they famous that it “felt structural, as if a fund or a desk was compelled to unwind positions unexpectedly.”

What’s Subsequent?

Naturally, after making an attempt to elucidate what occurred, the subsequent step is to supply a prediction of what’s to return. Nearly all of the crypto group appeared adamant that it is a correct buy-the-dip second, as comparable crashes are sometimes adopted by giant strikes in the wrong way.

“So sure, the headlines scream Market Crash. However zoom out the construction didn’t break. It simply reset. The whales already took their entry. Retail panic is peaking. And historical past says, that’s precisely when the subsequent leg begins,” stated Bull Concept.

CZ concurred, indicating that this could possibly be the subsequent “COVID crash,” when BTC dumped to $4,000 however exploded within the following months.

https://t.co/4O6i3MsfIA

— CZ

BNB (@cz_binance) October 11, 2025

Nonetheless, Crypto Bully outlined a distinct projection, which is much more painful if Trump proceeds with the tariffs:

“- Until Trump adjustments his statements instantly on Monday, this is not going to be a V reversal. Most alts with 50-70% wicks will bleed down and fill them or partially fill it earlier than reversal.”

Totally different Perspective

Whereas most are targeted on value drops, reasoning, and future habits, Cobie highlighted a distinct perspective on the state of affairs. The favored X person believes such collapses are an ideal instance of why buyers ought to keep away from taking leveraged positions, as they will wipe out years of positive factors.

As a substitute, they should deal with constructing a long-term portfolio by holding solely property that they’re bullish on and consider in. This implies avoid speculative tokens that solely chase hype with out precise utility.

“When everyone seems to be making hilarious quantities of cash I’m all the time tempted to start out utilizing leverage once more. It’s nearly unattainable to battle the sensation that you just’re not making sufficient, or everybody else is outpacing you. Good reminder that combating that feeling and keep away from the wipeouts is price it ultimately. Don’t let a leverage blowup dictate your long-term views. The long run is vibrant, good issues to return, persistence is rewarded.”

The put up Crypto Market’s Huge Meltdown: What We Know and What’s Subsequent appeared first on CryptoPotato.