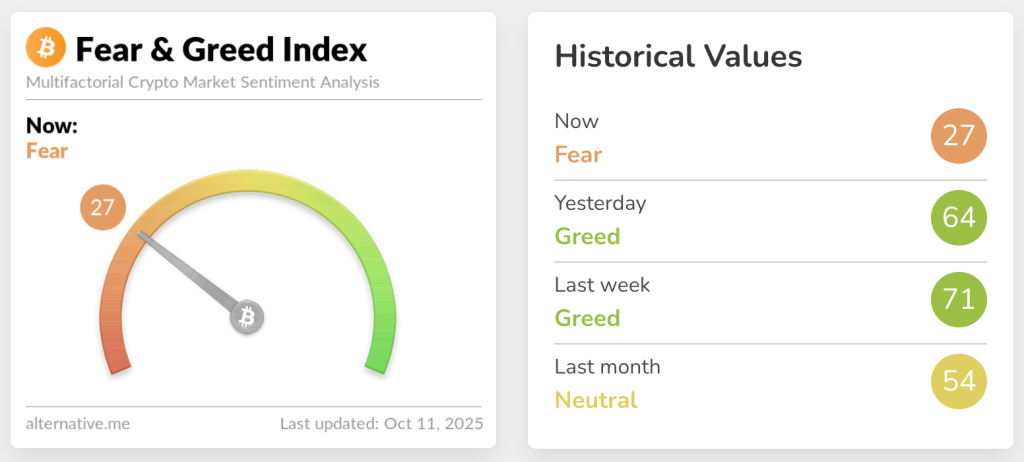

The crypto Concern and Greed Index plunged from 64 (Greed) to 27 (Concern) inside 24 hours following President Donald Trump’s announcement of 100% tariffs on Chinese language imports, triggering what CoinGlass described as “the biggest liquidation occasion in crypto historical past.”

Over 1.66 million merchants had been liquidated with whole losses exceeding $19.33 billion, although precise figures might surpass $30 billion in accordance with some estimates, as Binance solely stories one liquidation order per second.

Tariff Shock Erases $1 Trillion in Three-Hour Cascade

Bitcoin crashed from above $122,000 to briefly beneath $102,000, wiping out all positive factors since August, whereas Ethereum tumbled from $4,783 to $3,400 earlier than recovering.

The worldwide crypto market cap fell over 9% in 24 hours to $3.8 trillion, with roughly $1 trillion erased in simply three hours.

Greater than $7 billion in positions had been liquidated in lower than one hour of buying and selling on Friday alone.

Lengthy positions absorbed the majority of injury, totaling $16.83 billion in losses in comparison with $2.49 billion from shorts.

Bitcoin led liquidations at $5.38 billion, adopted by Ethereum at $4.43 billion, Solana at $2.01 billion, and XRP at $708 million.

Hyperliquid noticed the biggest single liquidation, an ETH-USDT place value $203.36 million.

The alternate dealt with $10.3 billion or roughly 53% of all liquidations, adopted by Bybit with $4.65 billion, Binance at $2.39 billion, and OKX at $1.21 billion.

The $10B liquidation determine floating round is pretend, the true quantity is probably going a lot increased, someplace within the $30B–$40B+ vary.

On Hyperliquid alone, almost $7B was liquidated. Right here’s the complete breakdown for anybody :

Complete liquidations since 20:45 UTC:

– Complete Worth:…— MLM (@mlmabc) October 11, 2025

The collapse dwarfed earlier file occasions, together with the March 2020 COVID crash that noticed $1.2 billion in liquidations and the November 2022 FTX collapse with $1.6 billion.

Friday’s occasion was roughly 20 instances bigger than the COVID crash, with Brian Strugats of Multicoin Capital noting the main target now turns to “counterparty publicity and whether or not this triggers broader market contagion.”

October’s Historic Power Faces Unprecedented Take a look at

Yesterday, Economist Timothy Peterson famous that drops of greater than 5% in October are “exceedingly uncommon,” occurring solely 4 instances previously decade throughout October 2017, 2018, 2019, and 2021.

Following every earlier drop, Bitcoin rebounded by 16% in 2017, 4% in 2018, and 21% in 2019, with solely 2021 seeing an extra 3% decline.

October ranks as Bitcoin’s second-best performing month on common since 2013, delivering common returns of 20.10% and trailing solely November’s 46.02% common achieve in accordance with CoinGlass information.

Drops of greater than 5% in October are exceedingly uncommon. This has occurred solely 4 instances previously 10 years.

Oct 24 2017

Oct 11 2018

Oct 23 2019

Oct 21 2021

What occurred subsequent? 7 days later bitcoin was

2017: up 16%

2018: up 4%

2019: up 21%

2021: down -3% pic.twitter.com/mbFs19RbwL— Timothy Peterson (@nsquaredvalue) October 10, 2025

If historical past repeats and Bitcoin mirrors its strongest October rebound of 21% from 2019, an identical transfer from Friday’s $102,000 low would place the cryptocurrency round $124,000 inside every week.

Nevertheless, Trump’s tariff announcement scheduled for November 1 in response to Beijing’s export restrictions on uncommon earth parts creates ongoing coverage uncertainty.

The president later hinted he might reverse tariffs if China modifications course earlier than the deadline, doubtlessly triggering a short-term market restoration, although liquidation losses stay locked in.

In keeping with Bloomberg, Caroline Mauron, co-founder of Orbit Markets, recognized $100,000 as Bitcoin’s subsequent main help stage, beneath which “would sign the top of previous three-year bull cycle.”

Bitcoin choices markets mirrored this view with the best variety of put strikes at $110,000 and the subsequent highest at $100,000, in accordance with Deribit information.

Analysts Cut up on Whether or not Liquidation Marks Backside or Extra Ache Forward

Jan3 founder Samson Mow maintained bullish sentiment, noting “there are nonetheless 21 days left in Uptober.”

MN Buying and selling Capital founder Michael van de Poppe known as the occasion “the underside of the present cycle,” evaluating it to the COVID-19 crash that marked the earlier cycle’s low.

The Bitcoin Libertarian took a longer-term view, suggesting that “in a number of years, Bitcoin will crash from $1M to $0.8M in a number of hours.”

David Jeong, CEO at Tread.fi described within the Bloomberg report that the market is experiencing a “black swan occasion,” noting that many establishments seemingly didn’t count on this volatility stage.

Equally, Vincent Liu, chief funding officer at Kronos Analysis, stated the rout was “sparked by US-China tariff fears however fueled by institutional over-leverage,” including that crypto’s macro ties had been now clear.

The Concern and Greed Index studying of 27 compares to 64 yesterday, 71 final week, and 54 final month, marking one of many quickest sentiment reversals in crypto historical past, with Bitcoin additionally touching over a 6-month low inside hours.

Technical Evaluation: Crucial Help Assessments for BTC and ETH

BTC presently trades round $111,522 after bouncing from the $102,000 low.

Speedy help sits at $110,000 to $113,000, with the $113,500 stage recognized as essential for triggering a aid rally.

$BTC dumped to $102,000 stage and almost took down the whole market.

Practically $20,000,000,000 in lengthy positions had been liquidated which is the best ever in crypto historical past.

Proper now, Bitcoin is making an attempt to reclaim $113,500 stage and if that occurs, you would see a aid rally. pic.twitter.com/F0UPgeTep2— Ted (@TedPillows) October 11, 2025

Resistance zones above present costs stand at $117,933, $124,475, and the latest excessive round $126,000.

The $20 billion liquidation cleared excessive leverage, doubtlessly eradicating promoting stress, although the sustainability of any bounce is dependent upon basic enhancements.

Quantity traits don’t reveal overwhelming conviction in both path.

ETH trades at $3,833 after testing $3,400, with instant resistance on the $4,000 psychological stage obligatory for upward momentum.

Help zones sit round $3,600 to $3,800, with failure to reclaim $4,000 seemingly triggering retests of those ranges.

Larger resistance stands at $4,080, $4,265, and $4,783. RSI indicators reached oversold ranges traditionally related to reversals, although these can stay depressed throughout real bear markets.

Each property face real uncertainty following the liquidation occasion.

Bitcoin should reclaim and maintain above $113,500 to validate restoration eventualities towards $117,000-$120,000, whereas failure would seemingly lead to retesting $102,000 or doubtlessly $95,000-$100,000.

Ethereum wants sustained buying and selling above $4,000 to set off momentum towards $4,200-$4,500, with a breakdown risking strikes towards $3,600-$3,800.

The clearing of leveraged positions removes instant promoting stress, although the unresolved tariff and potential for added volatility recommend consolidation between present ranges and up to date lows stays essentially the most possible near-term end result earlier than directional readability emerges.

The submit Crypto Market Flips from ‘Greed’ to ‘Concern’ in 24 Hours – Extra Crash Coming? appeared first on Cryptonews.