Ethereum continues to point out power, presently buying and selling round $4,670 because it edges nearer to the midline of its ascending channel. The market has maintained a gradual restoration since late September, however indicators of native exhaustion are starting to look, suggesting a possible short-term pullback earlier than one other push larger.

Technical Evaluation

By Shayan

The Day by day Chart

On the day by day timeframe, ETH stays firmly inside its rising channel construction, supported by the 100-day transferring common close to $3,900 and the 200-day round $3,000. The worth is approaching the $4,800 resistance zone, a key degree that has repeatedly capped rallies over the previous couple of months.

The RSI has additionally climbed to 62, reflecting wholesome momentum, although not but overheated. A breakout above $4,800 may open the trail to testing the psychological $5,000 degree and past, whereas failure to maintain present ranges may result in a retest of the decrease boundary of the ascending channel and even the vital $4,000 demand zone, which might be essential for the traders to carry to maintain the bull market.

The 4-Hour Chart

The 4-hour chart exhibits early bearish divergence between value and RSI, indicating weakening momentum as ETH exams the important thing $4,700-$4,800 resistance zone. But, a small bullish Honest Worth Hole (FVG) has shaped close to $4,600, which may entice short-term retracement and assist earlier than continuation.

If the patrons defend this hole and reclaim management, the following upside goal stays $4,800. Nevertheless, dropping this degree could set off a deeper correction towards $4,200, the place a robust demand zone and the neckline of the current inverse head and shoulder sample are situated.

Onchain Evaluation

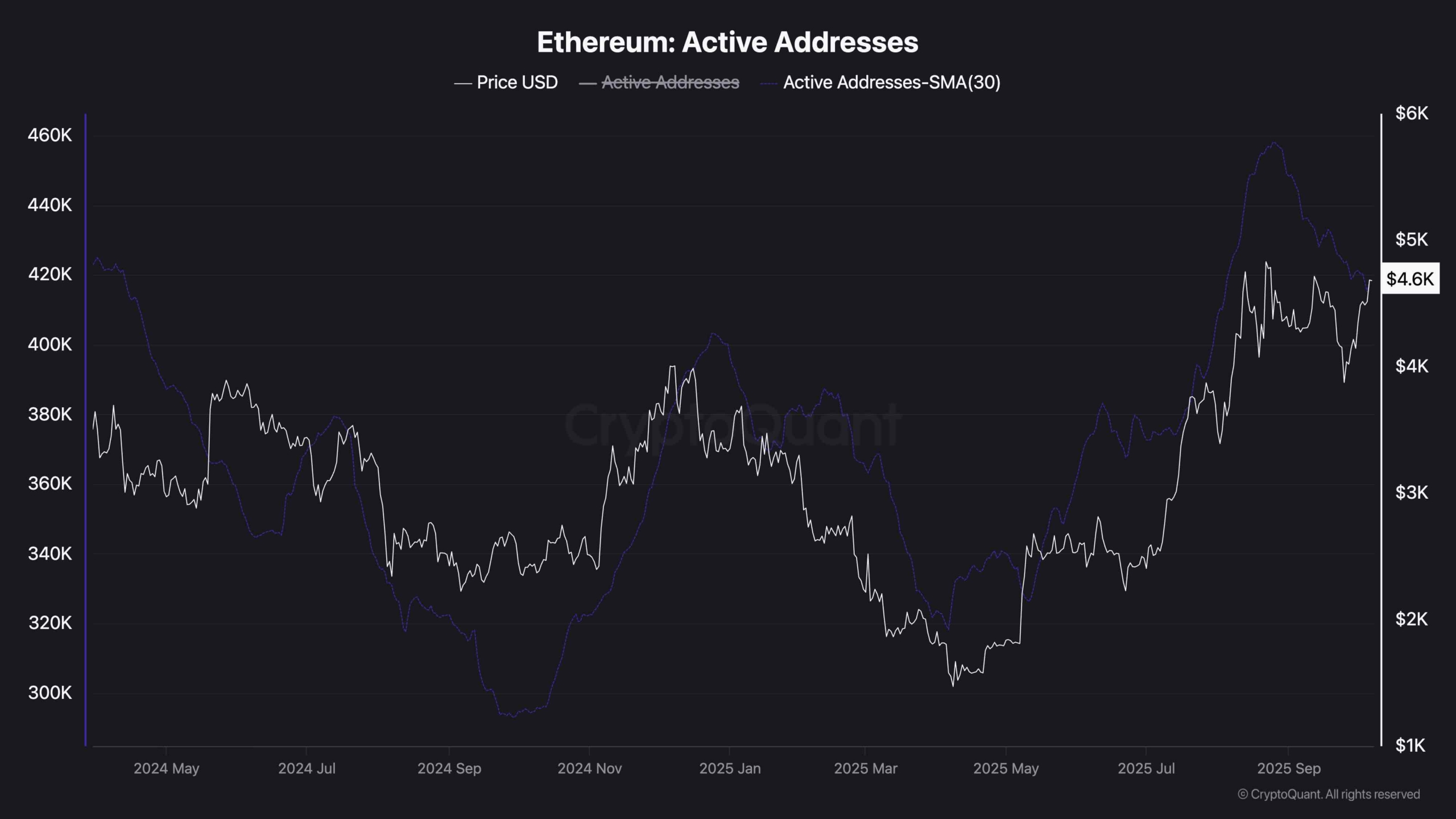

Whereas Ethereum’s value has been rebounding strongly and appears able to rally larger, on-chain exercise tells a barely completely different story. The variety of energetic addresses has been dropping barely lately, whilst the worth climbs. This exhibits a short-term disconnect between community participation and market efficiency.

For this uptrend to stay sustainable, energetic addresses must rise alongside value, confirming real person engagement and on-chain demand. A continued decline in exercise may sign weakening fundamentals, making it tougher for ETH to maintain momentum above the $4,700–$4,800 resistance zone.

The submit Ethereum Worth Evaluation: Worrying Fundamentals Would possibly Halt ETH’s Rally to $5K appeared first on CryptoPotato.