Company Bitcoin adoption is shedding steam as month-to-month information reveals that since July, there’s been a 95% drop within the variety of corporations adopting Bitcoin as a reserve asset, which has made many speculate whether or not the BTC bull run is over.

In keeping with current information from CryptoQuant, 2025 peaked with 89 new corporations including BTC to their stability sheets, up from simply 6 in 2020.

However that momentum is beginning to gradual.

The development began slowly with simply 4 corporations in January, then grew steadily via July, which noticed a peak of 21 new adopters.

Company Bitcoin Hype Shedding Steam?

2025 peaked with 89 new corporations including BTC to their stability sheets, up from simply 6 in 2020.

However that momentum is beginning to gradual.

Let’s break down what’s taking placepic.twitter.com/F3dzGnUb00

— CryptoQuant.com (@cryptoquant_com) September 16, 2025

Nevertheless, August marked a pointy reversal with solely 15 corporations becoming a member of – a drop of 6 from July’s excessive.

September has been even worse, with only one firm adopting Bitcoin to date.

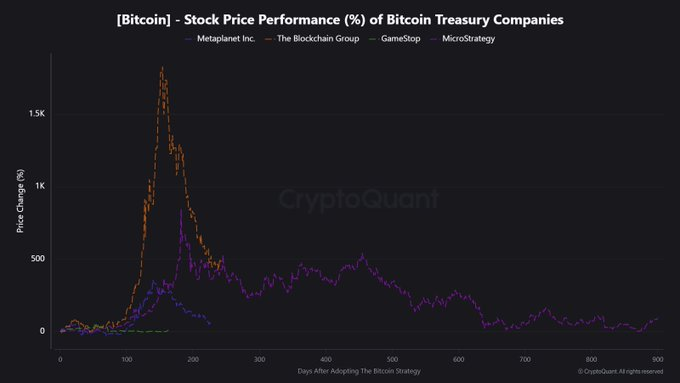

Equally, the inventory costs of most Bitcoin Treasury corporations are beginning to quiet down after large rallies.

For instance, the Blockchain Group, which went up +1,820% following Bitcoin treasury adoption on the peak, is now down 35% within the final month.

Equally, Metaplanet Inc noticed a +355% on the peak, now down 33.2% which is an indication that the Bitcoin adoption hype is deflating as actuality units in.

Company Bitcoin Adoption Key to BTC Bull Run

Analysts imagine the company Bitcoin accumulation has been a key driver of Bitcoin’s explosive rally.

Bitcoin is up 96.75% year-to-date (YTD), which has been principally because of company shopping for and institutional shopping for through ETFs.

Information from Bitcoin Treasuries reveals that over 3.7 million BTC are being held by treasuries. Public corporations maintain the second largest with over 1 million BTC, solely bettered by ETFs with 1.47 million BTC.

Nevertheless, economists fear that slowing company shopping for might damage Bitcoin costs, particularly if corporations begin promoting.

In keeping with a analysis report from Sentora shared with Cryptonews in August, analysts warn that company Bitcoin methods don’t work properly in rising rate of interest environments.

Most Bitcoin treasury corporations are unprofitable and depend on Bitcoin’s worth positive factors to remain solvent.

Vincent Maliepaard from Sentora calls these “negative-carry trades”, as corporations borrow cash to purchase Bitcoin, which produces no revenue.

Coinbase analysis provides that the company treasury development has shifted from straightforward income to intense competitors, warning that many individuals might fail throughout financial downturns.

Crypto analyst Ran Neuner claims many treasury corporations are simply exit schemes for insiders.

JP Morgan and different huge analysts predict a market dump earlier than a reversal.

The Fed will lower charges in simply 2 days.

JP Morgan and different huge analysts predict a market dump earlier than reversal.

Situation 1: $BTC will dump in the direction of $104,000 stage earlier than reversal.

Situation 2: Bitcoin will dump in the direction of $92,000, which additionally has a CME hole earlier than reversal and a… pic.twitter.com/Pq08pjMABR— Ted (@TedPillows) September 15, 2025

They mission that $BTC will dump in the direction of $104,000 stage earlier than reversal or dump in the direction of $92,000 stage, which additionally has a CME hole earlier than reversal and a brand new ATH.

Technical Evaluation: Bitcoin May Dip Beneath $100K However Bull Run Not Over

On the technical aspect, the Bitcoin every day chart is displaying weak point after getting rejected across the $116,600 zone, which aligns with final week’s excessive and the marked every day bearish breaker.

Worth is at present buying and selling close to $115,400, struggling to push larger, suggesting sellers are defending this resistance space strongly.

If momentum fails to reclaim and maintain above $116,600, the chart tasks a downward transfer that might first check final week’s low round $110,600.

A breakdown from there would expose deeper helps at $100,700, adopted by the yearly open at $93,576 and doubtlessly the $88,700 zone.

Nevertheless, many analysts assume that whereas BTC is down 7.24% from its all-time excessive, the crypto bull run isn’t but over.

Fundstrat’s Tom Lee believes Bitcoin might rally dramatically if the Federal Reserve cuts charges tomorrow..

He advised CNBC that crypto is very delicate to liquidity modifications, citing previous Fed pivots in 1998 and 2024 as examples.

Lee predicts a “monster transfer” in Bitcoin and Ethereum over the following three months.

Bitcoin and Ethereum might see a “monster transfer” within the subsequent three months if the Fed cuts charges this week, in keeping with BitMine’s Tom Lee @fundstrat.#bitcoin #ethereum #fedrates https://t.co/URV3VG2zY7

— Cryptonews.com (@cryptonews) September 16, 2025

In the meantime, Gold has surged 11% since late August, climbing from $3,300 to above $3,690 in an nearly uninterrupted rally.

Bitcoin has been a lot weaker. After rejection at $116,000, it dropped to $109,000 earlier than recovering, however stays caught in consolidation.

For Bitcoin to match Gold’s efficiency, it wants to interrupt above $116,000 resistance.

This might spark a transfer towards $120,000, and doubtlessly $125,000-$127,000 if momentum holds.

The publish Company Bitcoin Adoption Falls 95% Since July – BTC Bull Run Over? appeared first on Cryptonews.