Key takeaways:

- Nigeria, Africa’s biggest Bitcoin market, is becoming increasingly hostile towards cryptocurrency.

- The Central Bank of Nigeria has flip-flopped on Bitcoin, banning crypto transactions in February 2021 before half-heartedly lifting the ban three years later.

- The recent arrest of Binance’s Tigran Gambaryan and the pressure on other exchanges to delist naira pairs make it difficult for Nigerians to trade crypto using traditional methods.

- Despite the crackdown, peer-to-peer crypto trading continues to flourish.

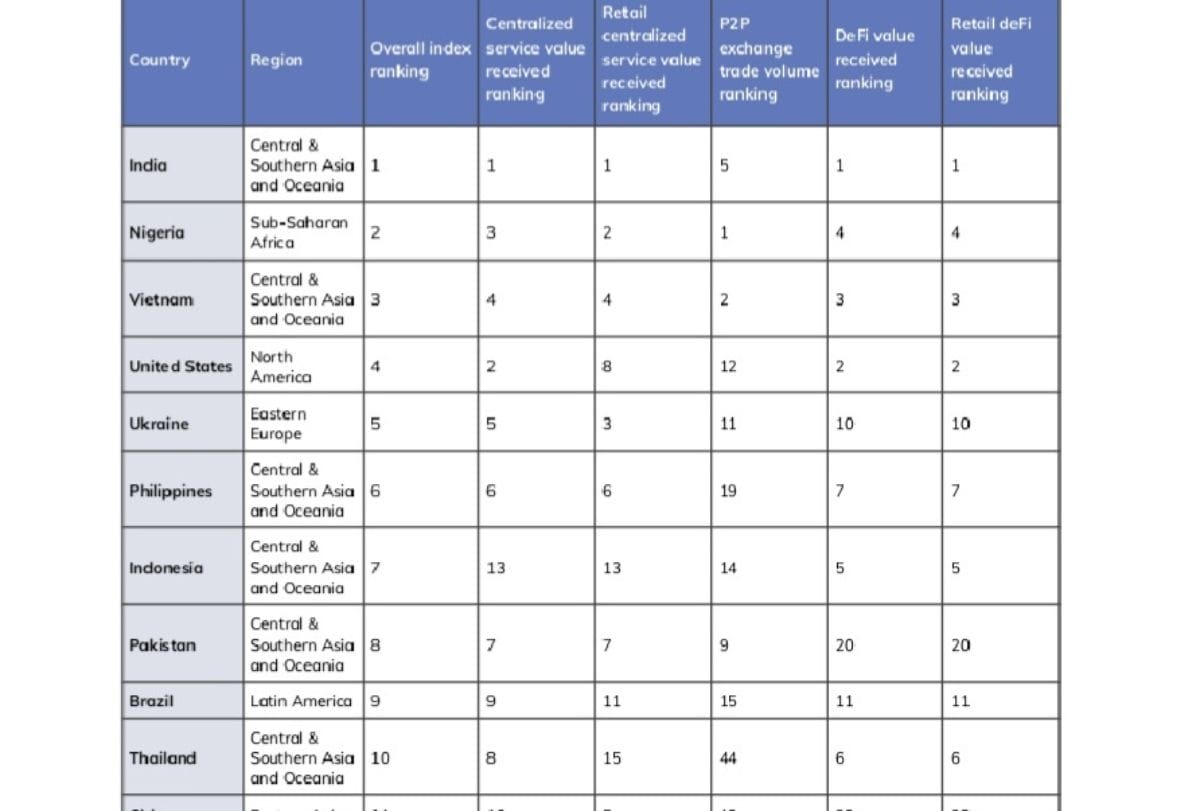

Nigeria is the biggest crypto market in Africa south of the Sahara. Chainalysis estimates that African countries collectively received $117 billion worth of Bitcoin between July 2022 and June 2023. Nigeria accounted for the lion’s share of this amount. However, over the last few years, the most populous African country has arguably become a snake pit for people and firms dealing in cryptocurrency.

The arrest of Binance’s Head of Financial Compliance, Tigran Gambaryan, in February epitomizes the changing operating environment in Nigeria. While Gambaryan himself was not charged, the court ruled that as an American national, he could face money laundering and tax evasion charges on behalf of his employer.

On July 12, a Nigerian court raised the stakes of a diplomatic fallout with the U.S. by remanding Gambaryan until October 11. The former U.S. Internal Revenue Service (IRS) agent, who has been taken sick with pneumonia and malaria in prison, appeared in court in a wheelchair.

U.S. diplomats and lawmakers have visited the Binance employee on at least 11 occasions, advocating for his release on humanitarian grounds. Meanwhile, the Congressman from Gambaryan’s home district has petitioned the Biden administration to recognize him as a “hostage held by an unaccountable government.”

Pushing Out CEXs

The Binance case has drawn widespread criticism for its personalized character, yet it’s just one of many examples of Nigeria’s ongoing strict actions against the cryptocurrency sector. The country is the world’s biggest peer-to-peer (P2P) cryptocurrency market, according to a 2023 Chainalysis report, but now it’s reevaluating its approach to this sector.

Authorities are scapegoating and driving out international exchanges. OKX, the world’s second-largest crypto exchange by trading volume, recently told its users that it will exit the Nigerian market in August 2024 due to regulatory uncertainty. Starting July 8, Kucoin introduced a 7.5% value-added tax on top of its 0.1% transaction fees for Nigerian users, blaming “changing local laws” for this unexpected action.

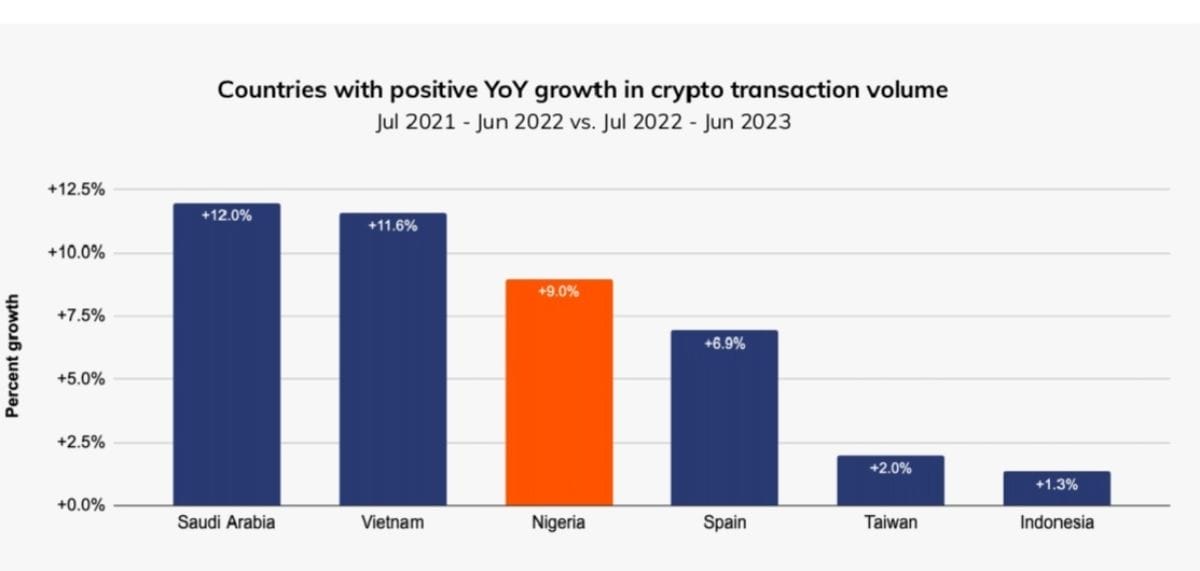

In May 2024, the Nigerian Securities and Exchange Commission (SEC) directed crypto trading platforms to delist trading pairs involving the naira. The SEC accused centralized crypto exchanges (CEXs) of manipulating the local fiat currency, causing inflation to spiral out of control. Since then, users have reportedly struggled to access exchange websites like Coinbase, threatening Nigeria’s 9% growth in crypto transaction volumes during the year leading up to June 2023.

Regulatory Bodies in Conflict With Each Other

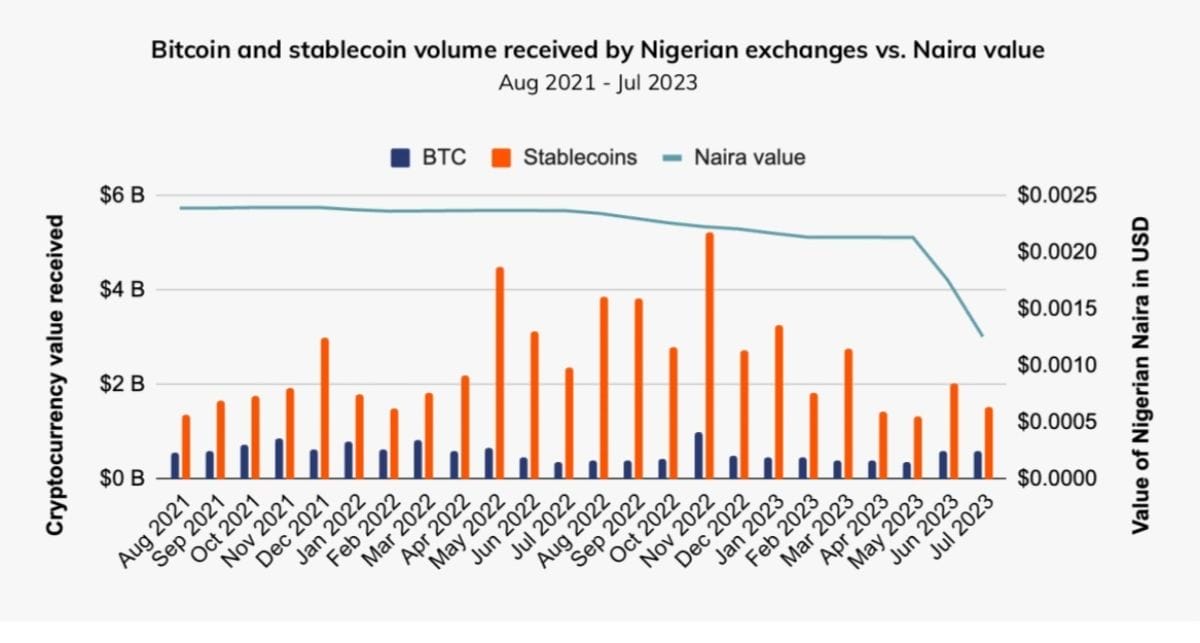

The naira is notoriously inflationary, which has particularly pushed young people to adopt Bitcoin as an alternative store of value. Since 2016, the West African country has experienced two major recessions, made worse by the Covid-19 pandemic and declining oil prices. In 2022, the Central Bank of Nigeria (CBN) revealed plans to redesign the naira notes to curb inflation and counterfeiting. However, this move led to cash shortages, and inflation surged to a record high of over 20% in early 2023.

This situation presented a conundrum for the Nigerian government. On the one hand, it could officially block companies that facilitate Bitcoin trade, risking the loss of potential dividends as traders go underground. On the other hand, it could allow cryptocurrency trading and expose the already fragile naira to further speculation.

Faced with what seemed like an impossible choice, Nigeria took a “good cop, bad cop” approach with its regulatory bodies, the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC). Nigeria’s support for financial innovation seemed superficial, as it often restricted cryptocurrency activities whenever problems arose.

Senator Ihenyen is a cryptocurrency lawyer and former president of the lobby group Stakeholders in the Blockchain Technology Association of Nigeria (Siban). When asked about the regulatory discord in Nigeria by Cryptonews, he pointed to an op-ed he published recently. “The SEC’s regulatory framework has remained inoperative apparently due to the stance of its more powerful sister agency, the CBN,” he wrote.

Ihenyen said Nigeria “taking the bull by the horns through crackdowns, clampdowns, and shutdowns” is a logical outcome of wasted opportunities to regulate crypto assets adaptively and proactively over the years.

“So when today P2P crypto platforms are projected to be the unwanted monster terrifying the economy, Nigerian regulators must accept that their collective failings created this ‘monster’,” he added.

In April, the CBN directed fintech startups Opay, Moniepoint, Paga, and Palmpay, to block the accounts of customers engaging in cryptocurrency transactions. Opay consequently warned customers off dabbling in crypto via its platform. “Any account that engages in these kinds of activities will be closed, and regulatory authorities will receive access to client information,” the company said in an advisory.

Evolution of Nigeria’s Regulatory Climate

The evolution of Nigeria’s regulatory climate ends where it starts, with a reactive central bank ban on Bitcoin and crypto transactions:

- January 2017: The Central Bank of Nigeria issues an advisory warning the public against investing in Bitcoin and other crypto assets, which it described as volatile, risky, and unregulated. People could lose their money forever, the Bank cautioned.

- February 2018: CBN issues a second statement doubling down on its warning from a year earlier. The advisory came two months after the price of Bitcoin soared to $20,000 in December 2023, gaining mainstream appeal.

- February 2021: Central bank governor Godwin Emefiele bans Bitcoin. He stops deposit-taking banks and other financial institutions from working with digital asset companies or individuals and orders the closure of all crypto-related bank accounts. CBN claims the measure is aimed at combating “organized gangs, money launderers and terrorist financiers.”

- October 2021: Nigerian crypto community challenges CBN circular banning digital currency transactions. The Federal High Court notes that the CBN governor’s February directive is not supported by law.

- October 2021: CBN launches its central bank digital currency (CBDC), e-Naira. It hopes the CBDC would boost Nigeria’s GDP by up to $29 billion within a decade. It fails dismally, with only 0.5% of the population using the asset by the end of October 2022.

- November 2021: The Central Bank of Nigeria intensifies its clampdown on cryptocurrency users. The Bank specifically targets young Nigerians aged between 18 to 30 years, with a directive to legacy banks to flag and shut down individual and corporate accounts linked to Bitcoin and other crypto-assets. Users of Binance, Paxful, Patricia and others are affected.

- 2021: Crypto trading goes underground on WhatsApp, Telegram, etc, and via decentralized exchanges (DEXs). Peer-to-peer markets flourish. Nigeria becomes the world’s biggest P2P cryptocurrency market.

- May 2022: Nigeria’s SEC introduces rules on issuance, offering and custody of digital assets, a regulatory framework to govern the industry. The rules are still not fully operational as of June 2024, according to Senator Ihenyen.

- 2022: The Money Laundering and Terrorism Act recognizes virtual asset service providers (VASPs) as “financial institutions” subject to supervision and AML compliance.

- May 2023: Nigerian government launches a National Blockchain Policy. The new policy is meant to work as a template for future legal frameworks for the broader cryptocurrency industry. The policy highlights ways in which the country could benefit from blockchain technology and related services.

- December 2023: CBN governor Olayemi Cardoso lifts a three-year ban on crypto transactions. He orders banks and other financial firms to start offering services to crypto exchanges. But there’s a catch. Exchanges still need to get an operating license from the SEC, which isn’t playing ball. It turns out the SEC does not have an operational framework for registration and licensing of VASPs.

- February 2024: Binance’s Tigran Gambaryan is arrested. His co-accused escapes to Kenya.

- April 2024: CBN circular directs fintech companies to close accounts of customers dealing in cryptocurrency.

- May 2024: The central bank directs crypto exchanges to delist naira trading pairs.

I was going to do a story about this, but I think a thread is more immediate.

Emperor Emefiele is on a rampage and he is actively going after Binance P2P users, in conjunction with the banks. FCMB, Kuda and GTB in particular. pic.twitter.com/tyCvGexWKX

— David Hundeyin (@DavidHundeyin) November 9, 2021

The Stakes of the Binance Case

Nigeria has leveled at least five accusations against Binance. These are:

- Facilitating the laundering of $35 million.

- Allowing currency speculation on its platform led to the naira’s inflation.

- Providing a conduit for terrorist funds.

- Handling illicit flows amounting to $26 billion.

- Not paying taxes.

Nigeria is demanding that Binance disclose the names of its top 100 users. It believes that some of these customers “who we cannot adequately identify” are drivers of some of the accusations above. However, the tax evasion charges have since been dropped.

Nigeria’s decision to prosecute the criminal compliance investigator on behalf of Binance seems questionable, not least because his position is not executive. In his previous capacity as an IRS agent, Gambaryan helped the U.S. recover $40 billion from a series of criminal rings. His reputation only serves to turn the optics of the case against Nigeria. Authorities in Nigeria are seemingly alert to Gambaryan’s line of defense.

What the Clampdown Means for Nigerians

Major centralized exchanges, including OKX and Kucoin, have all discontinued trading pairs involving the naira, concurrent with Binance’s fallout. For ordinary Nigerians, this is a moment of reality regarding the susceptibility of traditional finance to censorship.

Some analysts have noted that the limitation will not stop currency trade but send it P2P on social media and DEXs. Dangers of decentralized finance (DeFi) in this unregulated space include scams and few options for tracking lost funds and legal recourse.

For Lucky Uwakwe, chairman of the Blockchain Industry Coordinating Committee of Nigeria (Biccon), the clampdown on crypto goes against the spirit of Nigeria’s own National Blockchain Policy. The policy was designed to create an enabling environment for related businesses, including crypto. This means a loss of jobs for citizens as well as reduced access to trade and banking safeguards, Uwakwe told Cryptonews.

By extension, bad relations with major exchanges will limit the extent of financial services available to Nigerians.

“There is a policy right now in Binance where until the detained employee is released, any form of legal inquiry from the Nigerian government or customer support request from individuals is not attended to,” Uwakwe explained.

While the Biccon president stated that the government’s charges against Binance on naira manipulation were a ruse, he is not convinced the country has turned into a crypto pariah.

“We cannot say that Nigeria is a hostile nation to crypto given that exchanges like KuCoin are still operating, and individuals in Nigeria are even being taxed and remitting this money back to the government,” Uwakwe said. “While the maximum support has not been provided by certain quarters, Nigerians have not necessarily been disconnected from cryptocurrency as a whole.”

Strict Response Could Set Up Future Regulations

Nathaniel Luz, CEO of Flincap, a platform for locally-based over-the-counter crypto exchangers, sees the fallout between Nigeria and Binance as the historically inevitable clash between innovation and regulation.

“All the recent regulatory changes have had a positive impact on the market,” Luz said in an interview with Cryptonews. He sees the crackdown as creating an environment where local exchanges can thrive. “These local platforms are now experiencing significant growth, providing safer and more reliable services to users.”

As a result of the crackdown, Luz expects that the era of a major international exchange giant monopolizing the Nigerian economy is behind, allowing for regional giants based in Africa to take over.

Gambaryan’s Release Could Help Nigeria

Uwakwe urges the Nigerian government to unconditionally release Gambaryan and meet Binance at the negotiating table. He also challenges Binance to address the accusations leveled against it and negotiate redress.

“No citizen of any nation should endure this type of treatment based on where they work,” he said. “I hope the Nigerian government should listen for the sake of everyone, for the sake of the innocent individual who is more of collateral damage. The government must protect him and ensure the sustainability of this ecosystem in its own country.”

The West African country initially seemed to be open to dialogue. In January, it invited Gambaryan to address operational disputes. A few weeks later, however, Gambaryan was whisked off the roundtable to detention. There is already a lack of trust between the two parties. Binance alleges that Nigerian officials asked for a $150 million bribe for Gambaryan’s release. Nigeria flatly denied the allegations.

The post How Nigeria Went From Bitcoin-Friendly Nation to Crypto Pariah appeared first on Cryptonews.