The world’s largest asset supervisor, BlackRock, shocked the cryptocurrency market this week by snapping up greater than $1 billion price of Bitcoin and Ethereum for its exchange-traded funds (ETFs) in a single day, proper in the midst of one of many sharpest market pullbacks of the summer time.

On August 14, simply hours after hotter-than-expected U.S. Producer Worth Index (PPI) information despatched crypto costs tumbling, BlackRock’s iShares Bitcoin Belief (IBIT) and iShares Ethereum Belief (ETHA) executed considered one of their largest-ever each day accumulation strikes.

BlackRock’s Crypto Holdings Hit $100B After Aggressive ETFs Buys

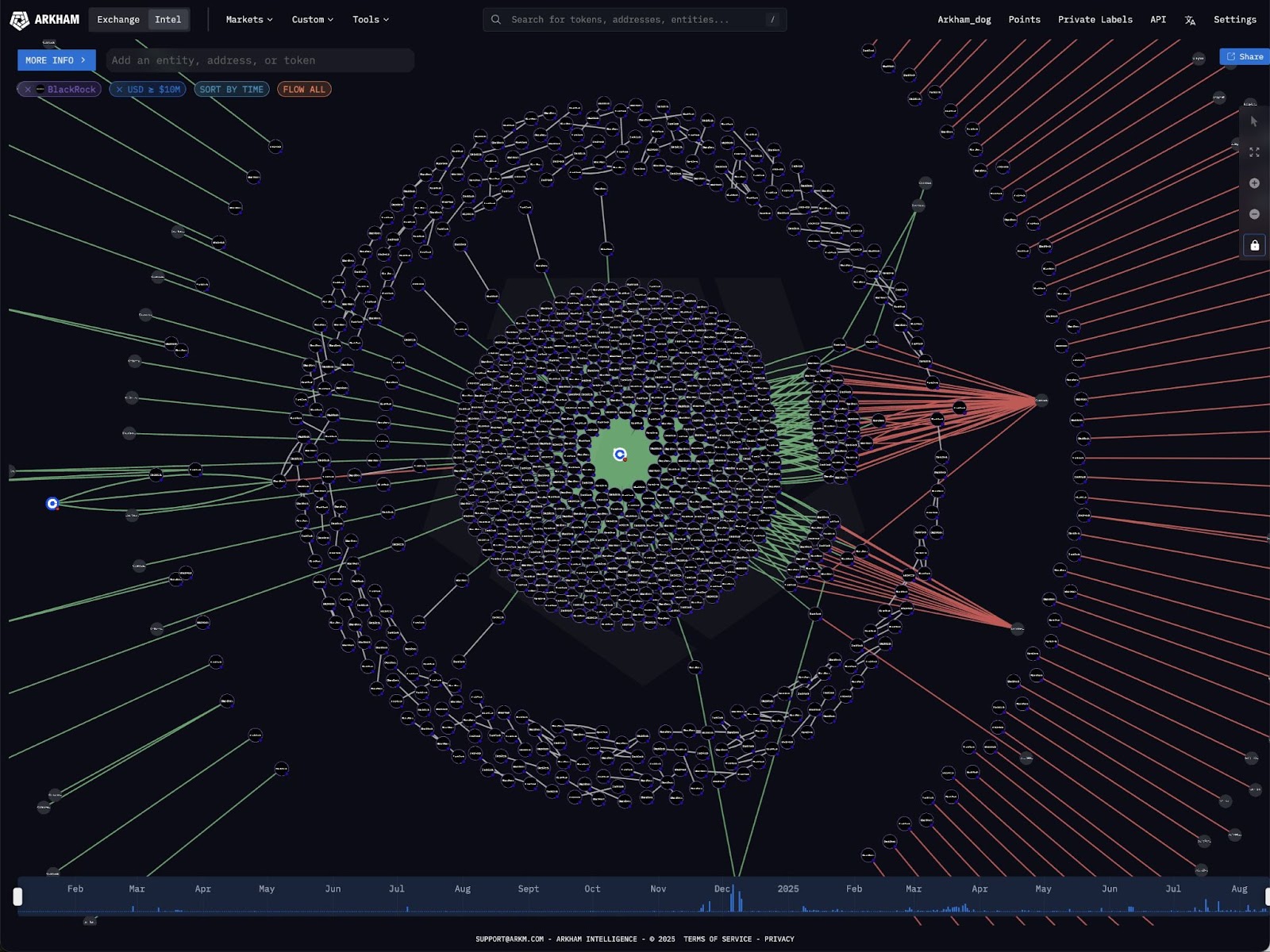

In line with Arkham, the agency purchased 4,428 BTC price roughly $526 million for its spot Bitcoin ETF and 105,900 ETH price roughly $488 million for its Ethereum ETF, bringing the whole each day buy to greater than $1 billion.

The aggressive shopping for spree got here after the Bureau of Labor Statistics reported that the Producer Worth Index (PPI) for July rose 0.9%, properly above economists’ forecasts of 0.2%, marking the sharpest year-over-year enhance since February 2025.

In consequence, Bitcoin had slipped from its recent all-time excessive above $123,700 to $119,098, whereas Ethereum plunged from $4,765 to as little as $4,452 earlier than recovering above $4,640.

The warmer-than-expected inflation information triggered a wave of risk-asset promoting, wiping $133 billion off whole crypto market capitalization in 24 hours and inflicting over $1 billion in leveraged positions to be liquidated throughout 221,000 merchants.

BlackRock went all in $BTC and $ETH yesterday.

After the new PPI information, BTC and ETH dumped shortly.

Throughout this dump, BlackRock purchased $523M price of BTC and $519M price of ETH.

This exhibits that massive cash desires some dip, in order that they’ll accumulate extra.

I hope you didn't promote… pic.twitter.com/TfNNlSCO3A— BitBull (@AkaBull_) August 15, 2025

For a lot of observers, the timing was telling. “BlackRock went all in on BTC and ETH yesterday,” stated dealer Bitbull. “This exhibits that massive cash desires some dip to allow them to accumulate extra. I hope you didn’t promote your cash to BlackRock.”

Regardless of the sell-off, U.S. spot Bitcoin ETFs pulled in $230.93 million in internet inflows on August 14, led nearly completely by BlackRock’s IBIT with $523.74 million.

Nonetheless, it was Ethereum that stole the highlight; spot ETH ETFs recorded $639.61 million in inflows, with ETHA alone bringing in $519.68 million. Constancy’s Ethereum Fund (FETH) adopted with practically $57 million.

These figures cap what has been one of many strongest months on file for ETH ETFs. Within the first two weeks of August alone, they’ve attracted greater than $3 billion in internet inflows, with a single-day file of $1.02 billion earlier this week.

Since launch, U.S. spot ETH ETFs have pulled in $12.73 billion, with cumulative internet property throughout the sector now at a file $29.22 billion.

BlackRock’s crypto holdings now whole round $100 billion, together with $90.36 billion in Bitcoin and $15.07 billion in Ethereum, making it by far the biggest institutional holder of each property. IBIT alone has grown to $91.06 billion in property beneath administration, representing 3.72% of the whole Bitcoin provide.

Macro Alerts, On-Chain Information Drive $1B Institutional Crypto ETF Buys

The shopping for spree has fueled hypothesis about what BlackRock and fellow heavyweight Constancy, who additionally added $55 million price of ETH on the identical day, could be seeing within the months forward.

Analysts level to a confluence of macroeconomic and market-structure components. With U.S. inflation cooling in current months and the Federal Reserve’s September charge minimize odds hovering above 90%, liquidity situations might enhance sharply heading into the fourth quarter.

For establishments, that’s typically the sign to “pre-position” by way of probably the most liquid and controlled funding wrappers, spot ETFs.

On-chain alerts additionally align with this playbook. Bitcoin’s short-term holder Spent Output Revenue Ratio (SOPR) has hovered close to 1.0, a stage traditionally related to loss-taking exhaustion and the resumption of upward traits.

The Crypto Worry and Greed Index shifted dramatically to excessive worry ranges earlier than coming again to 59 impartial immediately.

For Ethereum, community well being indicators, resembling energetic tackle progress, staking deposits, and stablecoin flows, have been ticking up quietly in current weeks.

“This appears to be like much less like retail ‘buy-the-dip’ and extra like data-driven institutional conviction,” one analyst stated. “BlackRock’s fashions are designed to purchase worth on weak spot when macro liquidity is ready to enhance. That’s precisely what we’re seeing now.”

Maybe probably the most hanging takeaway from August’s flows is Ethereum’s clear lead over Bitcoin. Whereas BTC ETFs have been internet optimistic, ETH ETFs have been posting larger each day prints and extra constant streaks, even within the face of market turbulence.

Some strategists see this as a “catch-up commerce.” After underperforming Bitcoin for a lot of 2024, ETH now advantages from a maturing ETF market, decreased regulatory overhang, and narratives round staking yield and tokenization of real-world property.

The macro backdrop could also be a key a part of the story. Odds of a Federal Reserve rate of interest minimize in September now sit above 90% following softer client inflation information earlier this month and indicators of cooling within the labor market.

Decrease charges have a tendency to learn danger property, significantly these delicate to liquidity situations, and establishments typically favor to pre-position earlier than coverage shifts slightly than chase rallies afterward.

The submit BlackRock Pours Over $1B into Bitcoin & Ethereum ETFs Throughout Dip — What Do They Know? appeared first on Cryptonews.