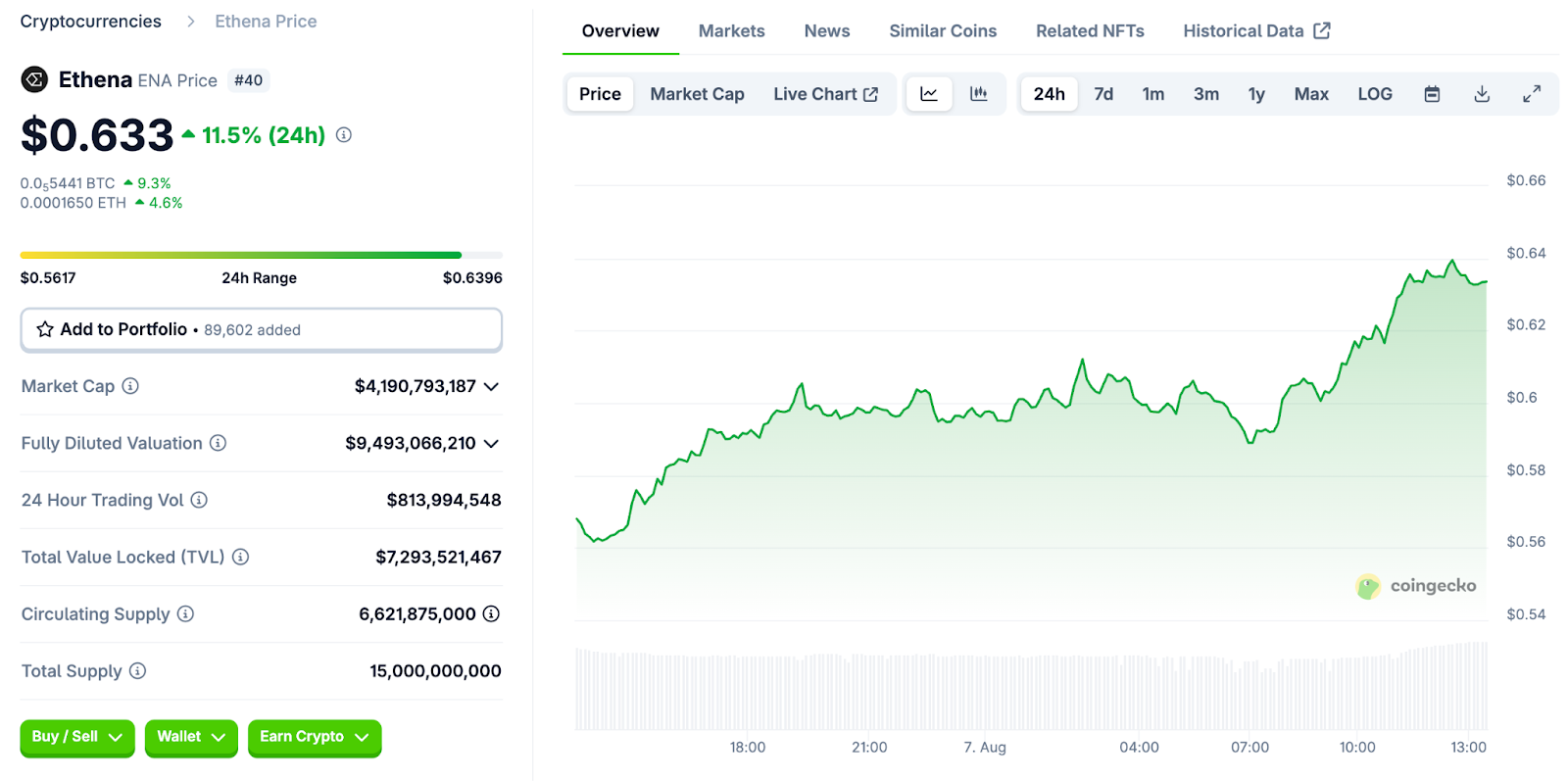

$ENA climbed 12% to $0.633 as buying and selling exercise surged, exhibiting renewed curiosity in Ethena’s governance token. The transfer comes amid main ecosystem developments that would form its near-term trajectory.

Whereas the token demonstrates sturdy market engagement, technical patterns recommend potential volatility forward. Merchants are actually monitoring key ranges on its worth chart as $ENA’s adoption soars regardless of shifting market dynamics.

Ethena ($ENA) Hits $9.5B FDV as Whales Scoop Up Tokens

Ethena ($ENA) operates with a hard and fast most provide of 15 billion tokens, of which 6 billion $ENA tokens are at present in circulation, with a completely diluted valuation of $9.49 billion. Moreover, the venture’s monetary efficiency stays sturdy.

In line with DefiLlama, the protocol has accrued $448.8 million in annualized charges and $101.13 million in annualized income, exhibiting critical financial exercise.

Moreover, on-chain evaluation reveals that “whales” have added over 1 billion $ENA tokens, indicating institutional accumulation and supporting bullish sentiment.

Whales simply purchased up over 1 billion Ethena $ENA. What do they know that we don’t? pic.twitter.com/i8xqXmHC6Q

— Ali (@ali_charts) August 5, 2025

In April, Ethena launched a weekly on-chain Proof of Reserves system for USDe, utilizing unbiased attestors (e.g., Harris & Trotter, Chaos Labs, and Chainlink) to confirm collateral backing, boosting transparency and belief.

The workforce additionally superior its “Convergence” roadmap by constructing a Layer-1 chain in partnership with Celestia and Arbitrum applied sciences.

Converge, the following Arbitrum chain.

Constructed by @ethena_labs and @securitize, @convergeonchain will function the settlement layer for onchain finance & RWAs w/ @celestia beneath.

$7b in dollarized asset liquidity corresponding to USDe and Blackrock BUIDL will probably be able to stream into DeFi. pic.twitter.com/bVJ6ylM0c3— Arbitrum (@arbitrum) April 17, 2025

By way of collaboration, Ethena partnered with the TON Basis to convey USDe and sUSDe to Telegram’s person base through a LayerZero bridge, increasing stablecoin attain throughout new on-chain communities.

Moreover, governance participation is excessive: the group votes on Aave for USDtb itemizing have handed with broad help, paving the way in which for brand spanking new borrowing methods and deeper liquidity loops.

Collectively, these dynamics sketch a story of real demand, structural help, and rising adoption—substances that would hold $ENA’s momentum scorching into the weeks forward.

$ENA Holds Increased However Faces Bearish Sample Threat

$ENA continues to carry its floor above $0.6300, buying and selling inside a rising wedge construction that’s beginning to tighten.

This wedge got here into deal with August 3 and rapidly matured. Rising wedges are value monitoring carefully, as these patterns are inclined to resolve decrease once they type after a protracted transfer up.

Regardless of the native bounce, worth has stalled just below the $0.6400 mark and is pushing into short-term resistance. The consolidation contained in the wedge comes from a reasonably clear three-wave advance off the $0.5200 stage. The three key easy transferring averages (20, 50, and 100-period) additionally proceed to slope upward, suggesting that the broader development stays bullish for now.

Alternatively, quantity has declined barely from final week’s aggressive leg larger, although it hasn’t collapsed totally. That leaves room for a retest of the higher wedge boundary and limits conviction except patrons push with extra urgency.

On the 1H quantity footprint chart, there was an apparent change in habits.

Though a number of candles across the $0.6280–$0.6340 zone confirmed a optimistic delta, a lot of them had sell-side strain stacked above the midline of the candles, which might level to absorption reasonably than power, particularly when it’s not accompanied by clear follow-through in worth.

Relating to derivatives and the investor perspective, open curiosity is up 11.93%, whereas quantity has remained flat. The lengthy/brief ratio skews barely towards the bull, because the ratio throughout widespread exchanges sits above 1.7.

Momentum indicators additionally look drained. MACD continues to be optimistic, however the histogram has been flatlining, hinting at weakening momentum. RSI sits round 58 and is curling barely decrease, an indication that bulls could lose the battle.

One factor is for certain because the token progresses: $ENA should reclaim $0.6400 with conviction and robust quantity, or it might fall via the help offered by the wedge towards $0.5200.

The submit $ENA Rises 12%: Whale Accumulation & $1 Breakout Potential appeared first on Cryptonews.