SharpLink Gaming, Inc. (Nasdaq: SBET), one of many largest company holders of Ethereum, has introduced a $200 million registered direct providing priced at $19.50 per share.

NEW: SharpLink raises $200M in a direct providing led by 4 international institutional buyers at $19.50/share

This capital will likely be used to broaden our Ethereum treasury, anticipated to surpass $2B upon full deployment

At SharpLink, our mission is easy:

Accumulate ETH. Stake ETH.… pic.twitter.com/ABv7CH9Cqt— SharpLink (SBET) (@SharpLinkGaming) August 7, 2025

The providing entails 4 unnamed international institutional buyers, displaying rising institutional curiosity in Ethereum as a treasury asset. The online proceeds will likely be used to additional broaden its ETH treasury, which is now projected to surpass $2 billion upon full deployment.

The transfer is a part of SharpLink’s ongoing technique to “accumulate ETH, stake ETH, and develop ETH per share,” because it positions itself as a central company participant within the area.

Institutional Backing Exhibits Rising ETH Confidence

The deal was facilitated by A.G.P./Alliance International Companions as lead placement agent, with Société Générale serving as co-placement agent. Cantor Fitzgerald is performing as the corporate’s monetary advisor.

The involvement of those international establishments reveals a shift, suggesting that Ethereum—usually seen as unstable or experimental—is being considered as a long-term asset by giant monetary gamers.

SharpLink Co-CEO Joseph Chalom described the providing as a “validation of our mission to be the world’s main ETH treasury.”

Chalom outlines the corporate’s ambitions to carry ETH and actively take part in Ethereum’s staking economic system and broader community infrastructure.

ETH as a Company Reserve: New Frontier or Dangerous Wager?

The aggressive ETH accumulation technique places SharpLink in a novel league. In contrast to conventional corporations that maintain money or short-term securities, SharpLink is leveraging its stability sheet to construct a crypto-native treasury mannequin.

The corporate’s staking actions additionally point out it’s incomes yield on its holdings—a transfer that’s in keeping with Ethereum’s post-merge shift to proof-of-stake.

SharpLink’s $200 million providing could function a bellwether for broader institutional motion into Ethereum. Whereas public corporations resembling MicroStrategy have adopted comparable treasury methods with Bitcoin, SharpLink’s ETH-centric mannequin could pave the way in which for others to diversify into Ethereum-based property.

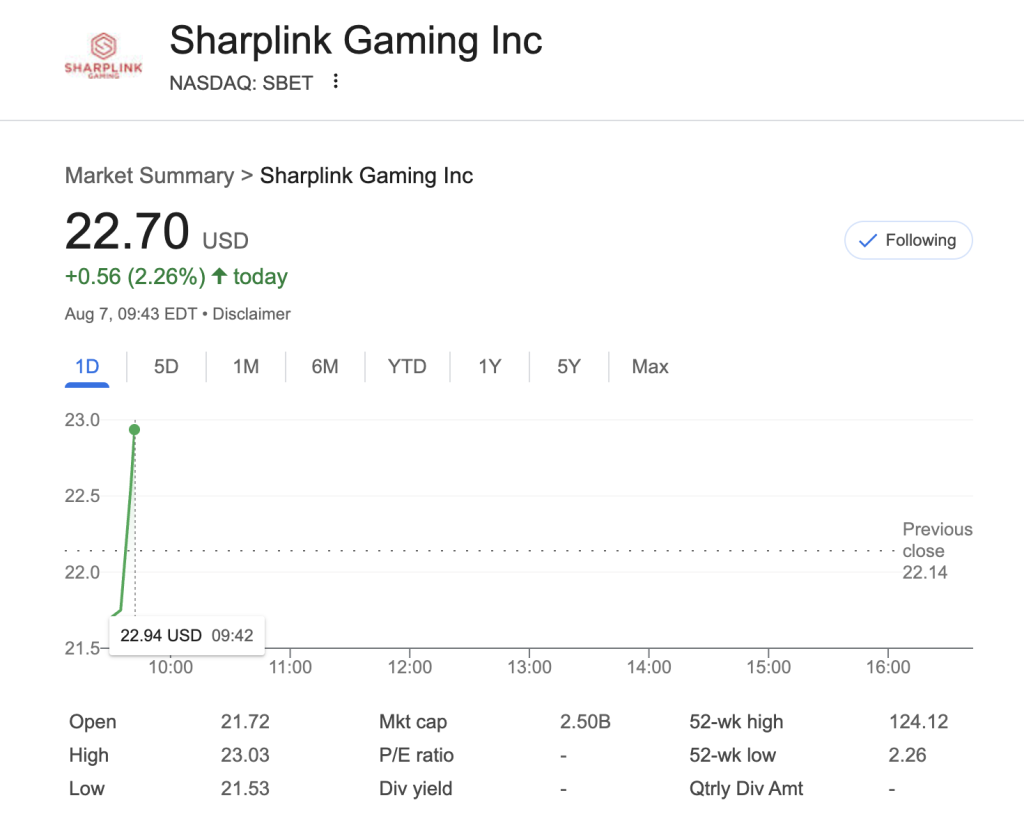

$SBET Value Motion

On Thursday, shares of SharpLink Gaming Inc. opened sturdy, rising over 2.2% in early buying and selling to $22.70, following latest information of its $200 million direct providing and growth of its Ethereum treasury technique.

The inventory opened at $21.72, surged to an intraday excessive of $23.03, and reached a market cap of $2.5 billion. With a 52-week vary spanning from $2.26 to $124.12, SBET has grow to be a carefully watched crypto-adjacent fairness.

The bounce in worth could mirror rising investor confidence in SharpLink’s aggressive ETH accumulation and staking roadmap.

The put up SharpLink Secures $200M to Double Down on ETH Technique – Establishments Shopping for ETH? appeared first on Cryptonews.