One of many many firms to transform to a BTC treasury has made changes to its already formidable plans for accumulating the asset.

The previous resort enterprise has posted some spectacular numbers since its transition, and it’s sustaining this tempo.

The Issuance Technique

The publicly traded firm, Metaplanet Inc., listed on the Tokyo Inventory Alternate, has launched a discover stating that it plans to extend the full variety of licensed shares (the utmost authorized quantity doable) that it might probably situation.

The Extraordinary Basic Assembly (EGM), led by the Board of Administrators, has determined to amend the Articles of Incorporation, particularly associated to the rise of those shares from 1.61 billion to 2.723 billion, permitting for extra versatile financing.

Moreover, a shelf registration (the method of registering securities for future sale, normally with a governing physique) was issued for Class A and B Perpetual Most well-liked Shares, as much as ¥277.5 billion ($1.8 billion), making a complete of ¥555 billion ($3.7 billion) in potential increase.

Perpetual Most well-liked Shares are a kind of inventory that pays a hard and fast dividend to traders for so long as the corporate stays in enterprise. It doesn’t have a maturity date or a selected buyback date, and there are notable variations between the 2 courses.

The previous might be deemed “safer,” however are much less versatile. Thought-about the next precedence, upon the agency making a revenue, shareholders of this class obtain cost first; nevertheless, promoting them again to the issuing firm will not be doable.

The latter might be described as “riskier” however extra versatile. As they’re of decrease precedence, within the occasion of economic struggles for the group, gross sales of Class B shares happen after these of Class A, with the important thing distinction being that this class might be transformed to common shares and offered at a later stage, offered sure standards are met.

The Acquisition Technique

At the start of June, the corporate introduced its plan to amass 210,000 BTC by 2027, representing a big improve from its preliminary objectives initially of 2025, which had been to accrue 10,000 BTC by the tip of 2025, adopted by 21,000 BTC by the tip of 2026.

That is all a part of the broader “555 million plan,” cleverly in step with the present objective of elevating ¥555 billion in most well-liked inventory. By mid-July, the company had achieved a 430.2% BTC yield, a key efficiency indicator (KPI) that displays the proportion change within the ratio of its Bitcoin holdings to totally diluted frequent shares.

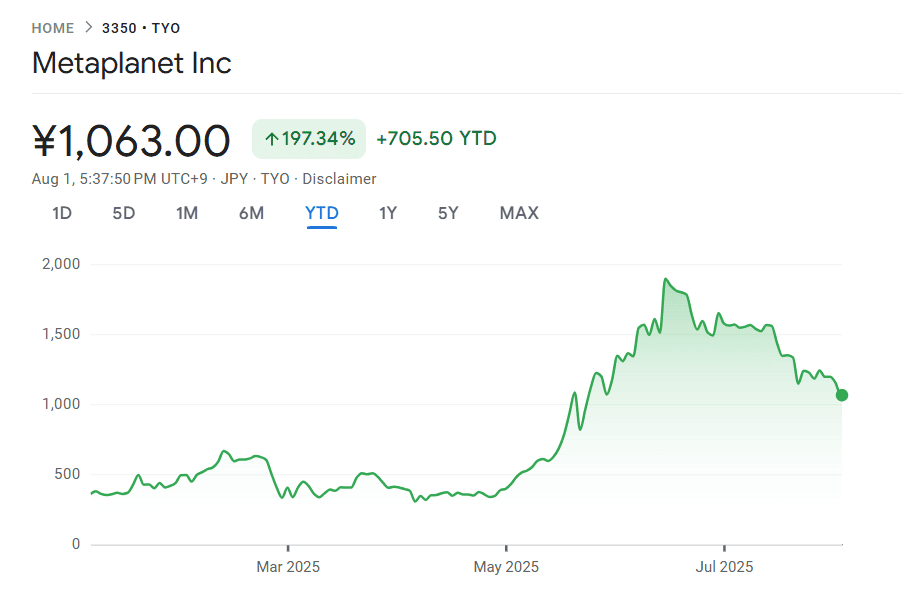

Naturally, consequently, the corporate’s market capitalization has additionally elevated, and is presently up over 190% year-to-date (YTD) on the time of printing, in accordance with knowledge from Google Finance.

On BitcoinTreasuries, the enterprise is presently ranked seventh with 17,132 bitcoins in its coffers, nearing the 18,430 stash of Trump Media, and with a noticeable lead over the 12,830 BTC held by Galaxy Digital Ltd.

These quantities correspond to $197 billion, $212 billion, and $148 billion, respectively.

The put up Metaplanet to Elevate One other $3.7 Billion for Additional Bitcoin Purchases appeared first on CryptoPotato.