Bitcoin’s mining infrastructure has developed into an energy-consuming large, requiring over 33 gigawatts of energy to keep up block manufacturing at the same time as community transaction exercise drops to its lowest level in practically two years, in response to a current evaluation from GoMining Institutional.

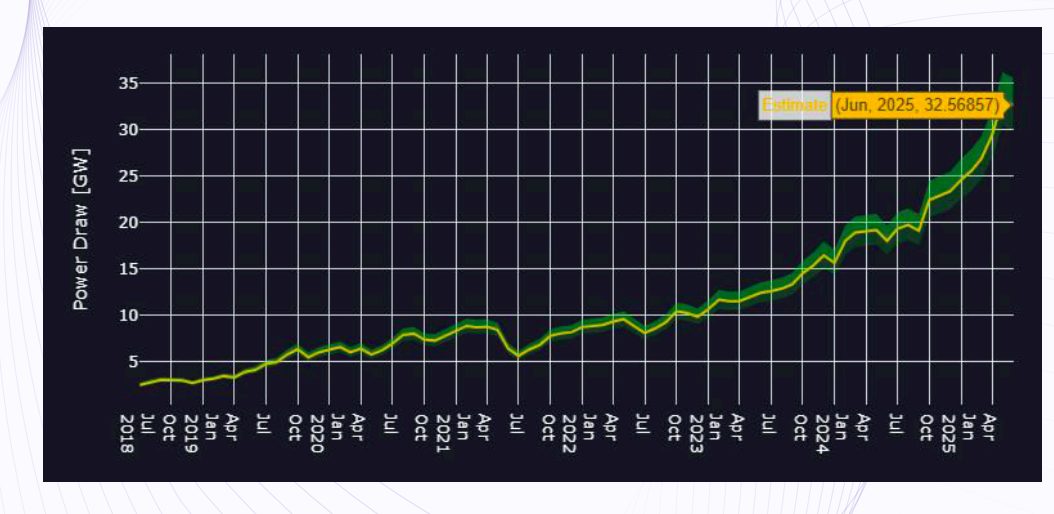

The GoMining Q2 2025 evaluation signifies that Bitcoin’s mining energy consumption surged from 15.6 gigawatts (GW) in January 2024 to 24.5 GW by January 2025.

The determine continued climbing to 33.1 GW by Could’s finish, marking a considerable 112% surge over 17 months.

Bitcoin Mining Energy Consumption Explodes Regardless of Effectivity Beneficial properties

The January-to-Could interval alone witnessed a 35% spike in power necessities, pushed by expanded deployment of power-intensive mining gear following the April 2024 halving occasion.

Bitcoin mining goes institutional — however can it survive AI grid wars, tariffs, and price collapse?#CryptoMining #AIhttps://t.co/uDm6hjxQun

— Cryptonews.com (@cryptonews) July 31, 2025

Fakhul Miah, Managing Director of GoMining Institutional, famous within the evaluation that whereas particular person mining units have develop into extra environment friendly, their fast enlargement is negating the community’s mining problem.

Bitcoin’s mining problem measures the computational problem required to find new blocks on the blockchain.

This parameter adjusts roughly each two weeks, or after 2,016 blocks, based mostly on modifications within the whole community hashrate.

Through the first half of 2025, the community underwent 13 problem recalibrations. Beginning at 109.78 trillion in January, it reached 116.96 trillion by June’s conclusion, representing a year-to-date acquire of 6.54%.

The typical month-to-month improve stood at 1.09%, considerably slower than 2024’s 4.48% month-to-month common.

The interval’s largest upward revision occurred on April 5 with a +6.81% adjustment.

Could thirtieth introduced a +4.38% change, pushing problem to a document peak of 126.98 trillion. This spike preceded two subsequent downward corrections.

June twenty ninth marked the community’s most vital problem discount since China’s mining prohibition, with Bitcoin’s problem falling by 7.48%, the sharpest drop since July 2021.

Transaction Charges Fall Under 1%: Bitcoin Miners Face Income Disaster

Whereas the community’s power consumption climbs, transaction exercise paints a special image.

In accordance with the GoMining evaluation, Bitcoin’s community utilization has retreated to ranges final noticed in October 2023.

The Bitcoin community has skilled a major drop in exercise, reaching ranges not seen in three years. #Bitcoin #Addresseshttps://t.co/OEAqYTfg9g

— Cryptonews.com (@cryptonews) September 5, 2024

The info reveals that the seven-day transaction common declined to roughly 313,510 on June twenty fifth.

June 1st recorded the bottom with simply 256,038 confirmed transactions.

All year long, customers have constantly broadcast transactions at a minimal 1 satoshi per digital byte price, no matter urgency.

At present Bitcoin valuations, 1 sat/vB equals roughly $0.115.

Transaction charges signify funds customers make to incorporate their transactions in blocks. In contrast to percentage-based bank card charges, these costs are calculated in satoshis per digital byte (sat/vB) based mostly on transaction dimension.

Whereas block subsidies stay mounted, transaction charges fluctuate in response to block area provide and demand dynamics.

Transaction charges now comprise lower than 1% of whole block rewards, making the primary half of 2025 significantly difficult for miners concerning fee-based income.

Nevertheless, a number of transient price income spikes emerged from distinctive market occasions.

April witnessed transaction price surges as Bitcoin’s worth climbed practically $10,000 inside two days.

Late Can also noticed sharp price will increase, indicating a heightened market exercise that contributed to Bitcoin’s new all-time excessive achievement.

Can Bitcoin Hit $150K? Mining Information Reveals Bullish Sign

Inspecting present Bitcoin manufacturing metrics for future worth implications reveals necessary concerns.

Elevated mining exercise sometimes indicators confidence in Bitcoin’s long-term profitability prospects.

Miners wouldn’t broaden power consumption and gear investments with out anticipating larger BTC costs to justify these bills.

Bitcoin requires worth appreciation to keep up miner profitability and community safety.

This dynamic might set up a worth ground, as miners might resist promoting beneath worthwhile thresholds, suggesting a medium to long-term bullish situation that would propel Bitcoin towards the favored $150,000 goal regardless of current market weak point that pushed it to $114,540 over the previous 24 hours.

The publish Bitcoin Mining Energy Use Jumps 112% to 33 Gigawatts as Community Transactions Hit 2-12 months Low: GoMining appeared first on Cryptonews.