Bitcoin — and the inventory market — hated “Liberation Day,” when Donald Trump unveiled plans to impose tariffs on a few of America’s closest buying and selling companions.

The world’s greatest cryptocurrency sunk to lows of about $75,000 within the week after his announcement in April, amid fears aggressive taxes on imported items would gas inflation and probably tip the U.S. into recession.

Equities and digital belongings quickly rebounded when Trump carried out one thing of a U-turn — saying that tariffs can be delayed so main economies may strike up commerce offers with the White Home.

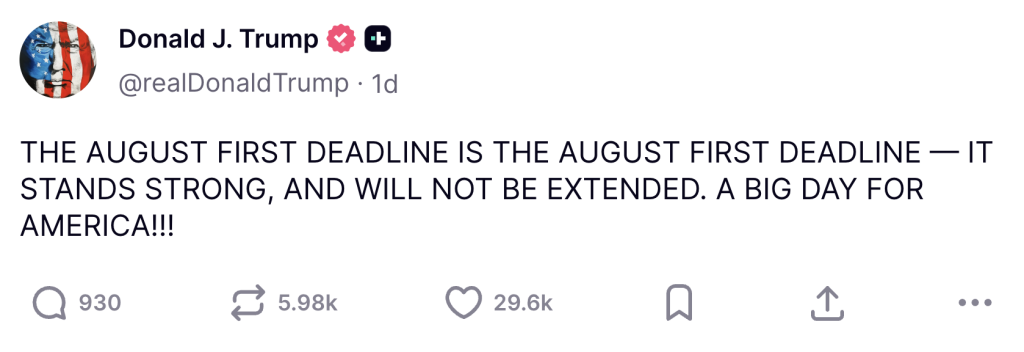

However the president made one factor clear: his deadline of 1 August was not going to be prolonged, which means nations that had failed to achieve an settlement with Washington by then would quickly take a extreme monetary hit.

A number of the world’s greatest economies have managed to attract up commerce offers with Trump over this timeframe — overlaying billions of shoppers — together with the European Union, the UK, Japan and South Korea.

However late on Thursday evening, a barrage of breaking information traces began to emerge from the White Home, revealing what dozens of nations — a lot of them poor — will now find yourself paying when their items are shipped to the States.

Probably the most headline-grabbing announcement issues neighboring Canada, the place tariffs on some items have now jumped as much as 35%. However Mexico, on the opposite facet of the border, has managed to safe one other 90-day reprieve.

About 90 nations are going to finish up dealing with elevated prices, with the BBC having a breakdown of a number of the nations affected:

Because the graphic above makes clear, even nations that aren’t explicitly named on this new govt order will nonetheless face a baseline tariff of 10%. This elevated commerce struggle goes to value all people one thing.

It’s value noting that a few of these tariffs received’t come into drive instantly. Most often, they’ll solely apply from 7 August — which means that there’s theoretically a small window of time for last-minute negotiations. The levies additionally received’t apply to items arriving by sea till the start of October, which may assist forestall dramatic value hikes when shoppers are searching for Christmas presents.

Asian shares took a battering early on Friday as buyers there digested the information — struggling their worst week since “Liberation Day” — and it’s probably that this will probably be adopted by extra of the identical throughout Europe and the Americas in a while Friday. Many consultants argue that mountain climbing levies to their highest stage since World Warfare Two is pointless and an act of financial self-harm.

24h7d30d1yAll time

Bitcoin, which trades 24/7, wasn’t proof against this newest bout of uncertainty. On the time of writing, it had fallen by 2.3% over 24 hours, however was persevering with to commerce above $115,000.

Altcoins have been faring far worse. Ether’s dropped by about 5%, with XRP’s losses nearer to six%. And as usually occurs throughout crypto corrections, it’s meme cash which are faring the worst — with pump.enjoyable shedding 20% of its worth and Pudgy Penguins plunging by 11%.

BTC may discover itself in a weak place if developments immediate institutional buyers to begin pulling their capital out of exchange-traded funds — exacerbating promoting strain. The resurgence of tariff discuss additionally takes the shine out of the White Home crypto report that was launched only a day earlier.

An enormous drawback for crypto and fairness buyers alike is the dearth of certainty that this newest bout of tariffs creates. Whereas there have been a flurry of high-profile earnings stories in current days, many are but to totally illustrate the affect that these commerce tensions are having on backside traces. Most retailers can have little selection however to cross on a number of the elevated prices onto clients, which may feed by way of into decrease ranges of spending.

There are additionally additional clouds on the horizon. We’re but to search out out whether or not the U.S. will have the ability to attain a cope with China — by far the world’s greatest exporter of merchandise — by a separate deadline of August 12. At one level in April, Trump had been suggesting that tariffs on Chinese language items may surge to a jaw-dropping 145%.

A recent flurry of erratic bulletins from Trump, full with decrease ranges of buying and selling through the summer time months, could properly imply that Bitcoin struggles to search out its footing for some time.

The publish Trump Tariffs Return — What Does It Imply for Bitcoin, Ether, XRP, Crypto? appeared first on Cryptonews.