Binance founder Changpeng “CZ” Zhao has identified that CoinMarketCap’s Altcoin Season Index is beginning to climb, predicting that an altcoin rally is likely to be imminent.

Key Takeaways:

- Binance founder CZ says the Altcoin Season Index is ticking up, hinting at a doable FOMO-driven rally.

- The index has climbed to 51, up from 16 final month, signaling rising momentum towards altcoins.

- Ethereum and meme cash are main positive factors, mirroring previous cycles the place altcoins outperformed Bitcoin.

“Undecided how correct it’s, however it’s ticking up. FOMO season quickly…” Zhao posted on X, referencing the index that tracks whether or not altcoins are outperforming Bitcoin over a 90-day interval.

The assertion comes as Bitcoin’s dominance fee continues to drop, indicating that merchants are more and more specializing in the broader cryptocurrency market.

Altcoin Season Index Climbs to 51, Up from 16 Final Month

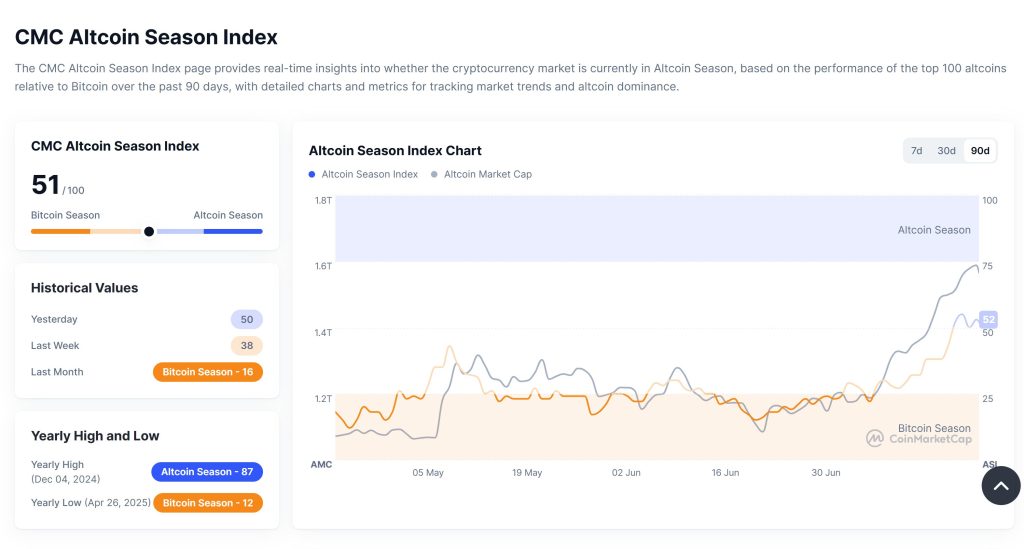

The Altcoin Season Index, maintained by CoinMarketCap, at present sits at 51 out of 100, up from 38 final week and simply 16 a month in the past.

A studying above 75 signifies an official “Altcoin Season,” the place not less than 75 of the highest 100 altcoins outperform Bitcoin over the earlier 90 days.

Whereas 51 falls wanting that threshold, the momentum displays rising market rotation into non-Bitcoin belongings.

Traditionally, these phases comply with a predictable sample: Bitcoin rallies first, lifting general sentiment and liquidity.

Ethereum and different altcoins then decide up, fueled by narrative-driven hypothesis, new protocol launches, and elevated developer exercise.

Within the 2021 altcoin season, for example, prime altcoins posted positive factors over 170%, in comparison with Bitcoin’s 2% throughout the identical interval.

Present knowledge helps that sample. Ethereum is up 110% over the previous 90 days, whereas meme cash like BONK (+148.7%) and FLOKI (+119.1%) have surged.

Even lower-cap tasks equivalent to PENGU and M have posted positive factors exceeding 500%, based on CoinMarketCap’s 90-day efficiency chart.

The methodology behind the index excludes stablecoins and wrapped tokens and as an alternative focuses on value efficiency among the many prime 100 cash listed on CoinMarketCap.

The aim is to assist traders gauge market sentiment shifts between Bitcoin-dominated durations and broader altcoin rallies.

Bitcoin Dominnace Falls Sharply

Bitcoin’s dominance within the crypto market has fallen sharply, dropping 5.8% in only one week to beneath 61%, its lowest level since March, and the steepest decline since June 2022.

The metric had peaked close to 66% on the finish of final month, based on TradingView.

The drop in dominance coincides with a surge in complete crypto market capitalization, which has jumped from $3 trillion to round $3.8 trillion over the previous three weeks.

Altcoins, notably Ethereum, have led the rally as traders shift focus away from Bitcoin.

“Everyone seems to be saying ALTSEASON has began however should you take a look at indicator they are saying ~ Not but,” X consumer Henry stated in a current submit.

They added that not one of the 30 bull market prime indicators have triggered but, with Bitcoin dominance at 61%, the Altcoin Season Index at 51, and key metrics like Puell, MVRV Z-Rating, and Mayer A number of nonetheless in protected territory.

Everyone seems to be saying ALTSEASON has began however should you take a look at indicator they are saying ~ Not but.

Out of 30 bull market prime indicators, not a single one has triggered.

• Bitcoin dominance remains to be excessive at 61%

• Altcoin Season Index is sitting at 51/100 (must hit 75+)

• Puell,… pic.twitter.com/NU92VlpWZN— Henry (@LordOfAlts) July 21, 2025

The submit Billionaire Binance Founder Says ‘FOMO Season Quickly’ as Altcoin Index Begins Ticking Up appeared first on Cryptonews.