Bitcoin’s upward momentum has weakened because it approaches the important thing $111K resistance zone, growing the danger of one other rejection.

Nevertheless, bullish sentiment stays intact, with market individuals anticipating a breakout, although a renewed inflow of demand is important for any sustained transfer past the all-time excessive.

Bitcoin Worth Evaluation: Technicals

By Shayan

The Each day Chart

BTC continues to face challenges in surpassing the important thing $111K resistance degree, its present all-time excessive, after a number of weeks of consolidation. Regardless of a number of makes an attempt, intensified promoting stress and profit-taking at this degree have repeatedly halted bullish momentum, leading to sideways worth motion.

Just lately, the cryptocurrency dipped under the $100K help zone, triggering a liquidity sweep and accumulating the gasoline for a possible new leg up.

Nevertheless, the next rebound has stalled across the $107K mark, signaling weakening bullish power. If demand returns and shopping for stress will increase, a breakout above the $111K ATH may materialize. In any other case, one other rejection is probably going, pushing the value again towards the essential $100K help within the coming periods.

The 4-Hour Chart

On the decrease timeframe, Bitcoin has been forming a bullish flag just under its all-time excessive, a sample usually signaling continuation of the present uptrend.

Following a liquidity seize beneath the decrease boundary of the flag close to $100K, Bitcoin rallied towards the higher boundary at $107K. Regardless of this upward transfer, the value has entered a low-volatility section, indicating a lack of momentum because it approaches resistance.

Ought to a breakout happen early subsequent week, a brand new all-time excessive is probably going. Conversely, failure to carry above the present degree may set off one other drop, sending the value again towards the decrease finish of the flag. Till then, worth motion stays confined, with each bulls and bears ready for affirmation of the subsequent directional transfer.

Bitcoin On-chain Evaluation

By Shayan

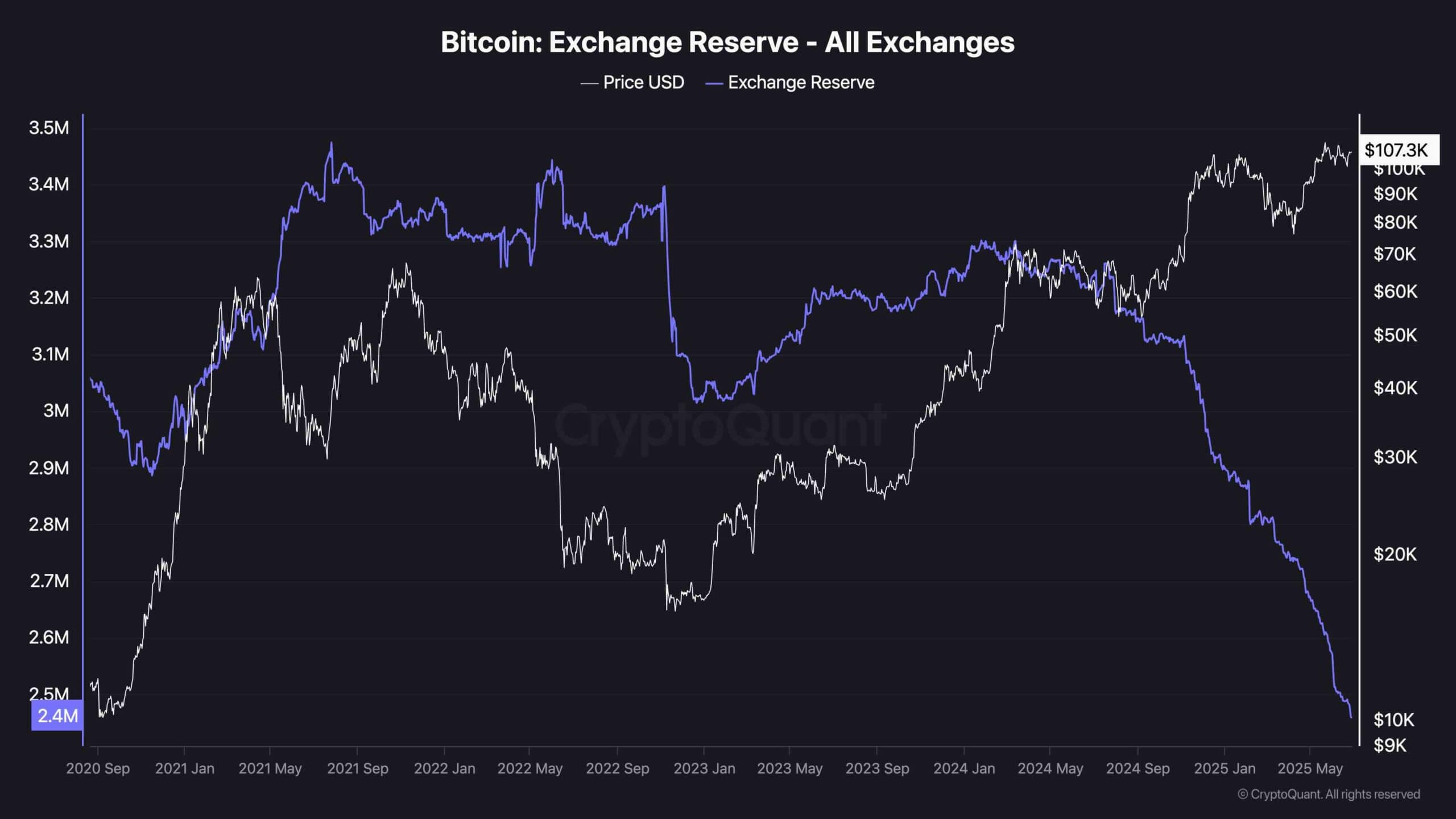

On-chain information from CryptoQuant reveals a pointy decline in Bitcoin reserves held on centralized exchanges, now at their lowest ranges in a number of years.

This ongoing outflow underscores a rising choice for self-custody and accumulation amongst traders, a sample usually related to diminished sell-side stress and a long-term bullish outlook. A decrease provide of available BTC on exchanges usually units the stage for potential supply-side shocks in periods of renewed demand.

That stated, whereas dwindling reserves are traditionally correlated with main bull runs, they shouldn’t be seen as rapid catalysts for short-term worth rallies.

Market situations and liquidity dynamics nonetheless play a significant function, and with no corresponding uptick in demand, worth corrections stay a chance. In abstract, the trade reserve pattern highlights sturdy foundational help for Bitcoin, however near-term worth motion should still be topic to broader macro or technical headwinds.

The publish BTC Worth Evaluation: Is Bitcoin About to Break Above its ATH and Head to $120K? appeared first on CryptoPotato.