Bitcoin’s worth misplaced 2.29% within the 30 days ending Jun. 24. In the meantime, a bevy of tech shares like Palantir, Nvidia, and Oracle are flying excessive. Is the BTC bull market over?

Or can BTC nonetheless hit the $150K – $200K worth predictions for 2025, not too long ago made by common crypto investing commentators?

Crypto exchanges are dynamic, fast-moving, open, international markets for these excessive tech Web currencies. So nobody is aware of for positive what Bitcoin’s worth will do subsequent till markets have moved.

However there are some clues and historic patterns that savvy foreign money merchants and buyers use to determine what and when to purchase, promote, and maintain.

The day by day actions in June’s Bitcoin costs have confounded the bullish 12-month and 24-month development. Right here’s a fast rundown of Bitcoin vs. chosen tech shares in June.

Bitcoin Severely Lags Tech Shares in June 2025

For the 30 days ending Tuesday, Jun. 24, Bitcoin fell greater than 2%.

However international commerce coverage and navy instability aren’t weighing on a number of essential US tech shares.

Santa Clara, California-based laptop chipmaker Nvidia, for instance, the second highest-weighted US inventory by market dimension, gained over 9.15% in share costs.

In the meantime, Denver, Colorado-based US information firm Palantir, gained over 19.84%. Oracle, one other high-tech information firm, primarily based in Nashville, Tennessee, and ranked #17 amongst all US firms by dimension, surged 32.5% for the 30-day window by market shut on Tuesday.

All three firms are ultra-high market cap with many helpful factors of comparability to Bitcoin, the world’s main cryptocurrency. They’ve been rallying, whereas BTC retraces its April and Might features.

So is the crypto rally tapering off?

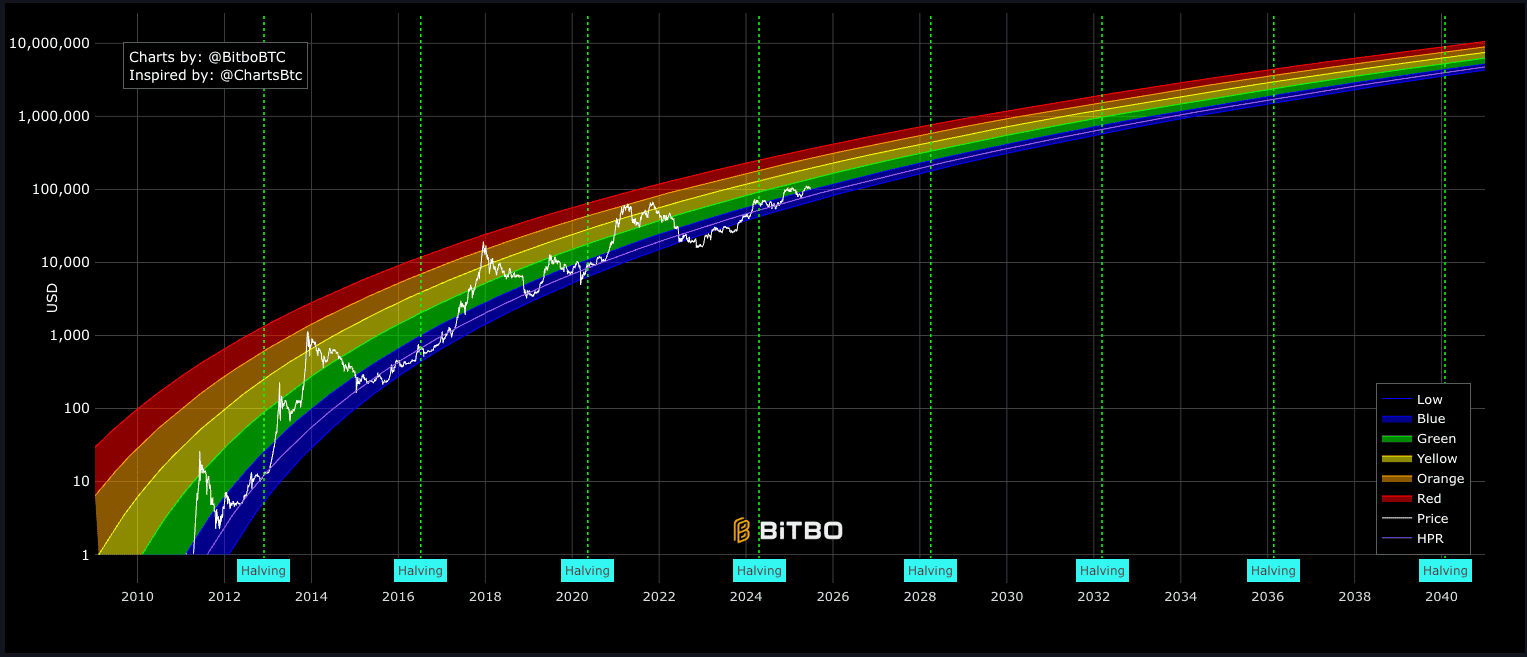

Bitcoin Value Rainbow Chart Recommends ‘BUY!’

Many consultants don’t suppose so. A bear market in Bitcoin any time quickly additionally doesn’t align with the historic development.

In response to the Bitcoin Rainbow Chart, a preferred buying and selling suggestion instrument primarily based on Bitcoin’s historic worth development, the value seems removed from its multi-year cycle peak.

In reality, it’s comparable on the rainbow chart to earlier markets like Nov. 2020 and Might 2017.

The Might 2017 market valued BTC at $1,434 per token on Might 1. By Dec. 17, 2017, the value had skyrocketed to simply above $20,000, for a 1,400% ROI in below 9 months.

The Nov. 2020 market appraised Bitcoin at $13,862 on Nov. 1. By Apr. 15, 2021, the value rallied to $62,208, for a 450% ROI in below 6 months.

Legendary veteran inventory market chart dealer Peter Brandt expects Bitcoin to maneuver as excessive as $150,00 by August or September.

In an interview on CNBC’s Squawk Field in Might, Galaxy Digital founder Mike Novogratz stated he expects the value to high out above $150,000 earlier than this cycle is over.

The submit Bitcoin Value Trades Sidewise In June: Is The Bull Market Over? appeared first on CryptoPotato.