Bitcoin continues to hover in a consolidation vary after failing to interrupt above the $110K resistance. The broader market stays unsure, with spot and derivatives information suggesting blended sentiment.

Because the weekly shut approaches, the value motion is squeezed between dynamic helps and a persistent provide zone. This section might precede a big breakout or breakdown relying on how liquidity behaves within the coming periods.

By ShayanMarkets

The Day by day Chart

On the each day timeframe, BTC has fashioned a triangle sample, with virtually equal lows close to $100,000 and decrease highs marking sustained promoting strain. The important thing trendline assist from March stays intact, preserving the value contained in the bigger ascending channel.

The asset is at the moment making an attempt to stabilize close to $106K, with the RSI hovering round 51, a impartial stage indicating a balanced momentum. If the patrons fail to push above the descending resistance and the $110K provide zone, draw back liquidity beneath $100K could turn into a goal.

The 100 and 200-day shifting averages are rising and converging for a bullish crossover, indicating the long-term bullish construction stays intact. Nonetheless, the truth that BTC has been rejected a number of instances from the $110K space makes that zone a important resolution level.

A each day shut above it might shift the construction bullish once more, whereas a breakdown beneath the orange trendline assist could speed up a transfer towards the decrease boundary of the massive channel.

The 4-Hour Chart

Within the 4H chart, BTC has rebounded from an area low of $103K, leaving a big pool of liquidity behind. The value is now pushing again into a good worth hole (FVG) within the $106K zone, which is now performing as a provide barrier. Furthermore, the RSI is trending larger at 55, displaying delicate bullish momentum, however the bearish trendline overhead nonetheless caps any impulsive transfer.

A breakout above the FVG with robust quantity might open the trail to retest $110K. In any other case, if sellers defend this space once more, we may even see a sweep beneath $103K, aiming for the $102K and even $100K liquidation zones. The short-term construction leans barely bullish, however the market stays range-bound between liquidity swimming pools.

Spot Sentiment Evaluation

Spot Taker CVD

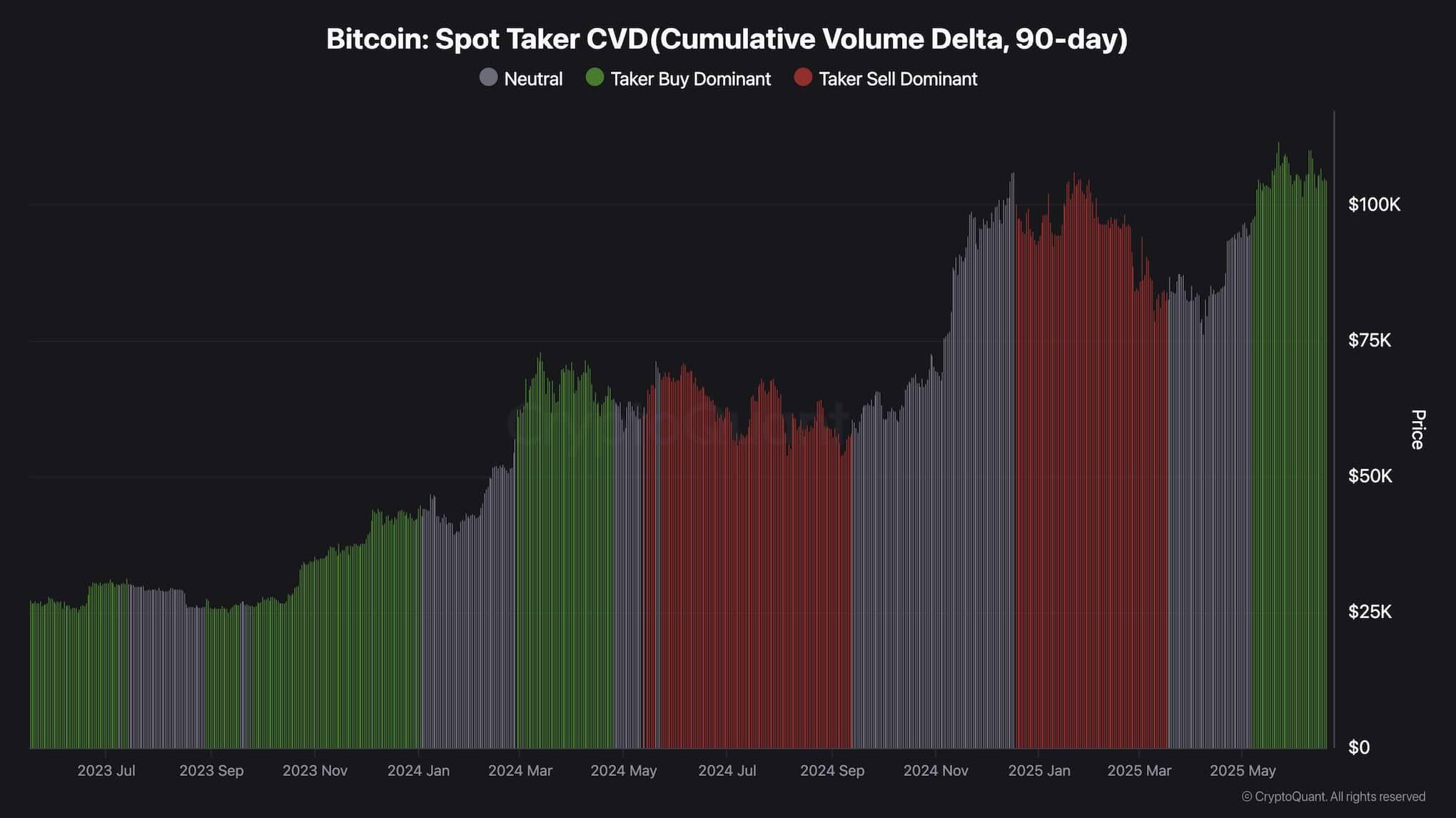

The Spot Taker CVD chart over the 90-day view exhibits a return to aggressive shopping for dominance (inexperienced), following a protracted interval of impartial and promote strain. This shift signifies that market patrons are stepping again in with confidence, absorbing promote orders at present costs. Traditionally, when CVD flips inexperienced after prolonged pink or gray phases, it precedes upward continuation.

This renewed spot demand suggests that giant patrons are positioning themselves throughout this vary section. If this habits continues whereas the value holds above key helps, it might result in a robust breakout. Nonetheless, if the CVD begins to flatten or flip pink once more with out value advancing, it could point out exhaustion and foreshadow one other sweep of draw back liquidity or perhaps a full-blown bearish reversal.

The put up Bitcoin Value Evaluation: BTC Breakout Looms – Is $100K or $110K Subsequent? appeared first on CryptoPotato.