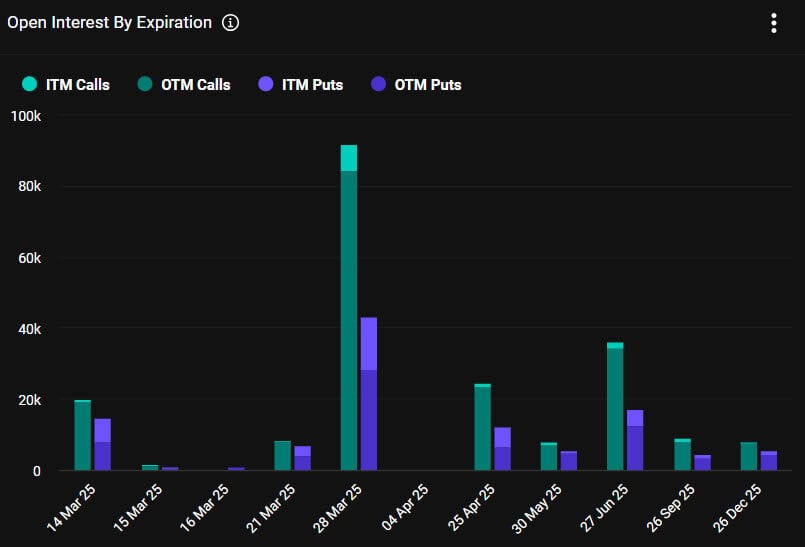

Round 35,000 Bitcoin choices contracts will expire on Friday, March 14, they usually have a notional worth of roughly $2.9 billion.

This week’s occasion is slightly bigger than final week’s, however a mammoth end-of-quarter $11 billion choices contract expiry is due on March 28.

The influence on spot markets is more likely to be minimal as markets digest barely lower-than-expected inflation information from the US this week.

Bitcoin Choices Expiry

This week’s batch of Bitcoin choices contracts has a put/name ratio of 0.73, that means that there are barely extra name (lengthy) contracts expiring than places (shorts).

Furthermore, open curiosity (OI), or the worth or variety of BTC choices contracts but to run out, stays excessive on the $120,000 strike worth, which is $1.4 billion, based on Deribit.

There may be additionally nearly $1.6 billion in OI on the $100,000 strike worth and $1.3 billion at $120,000. Nevertheless, the bears are getting bolder, betting nearly $850 million that Bitcoin will fall to $70,0000.

Crypto derivatives supplier Greeks Stay stated the group was nonetheless “predominantly bearish” on the short-term market outlook regardless of some optimistic CPI information.

“Merchants are watching key potential help ranges and discussing a possible backside for BTC, with some suggesting $60k ranges as a attainable draw back goal.”

It added that “skepticism prevails” because the market light the nice CPI print rapidly. Different trade consultants and analysts have been baffled as to why there’s a lot bearish sentiment amid extraordinarily bullish fundamentals.

Along with the Bitcoin choices, there are round 220,000 Ethereum contracts which can be additionally expiring at present, with a notional worth of $416 million and a put/name ratio of 0.68. This brings Friday’s mixed crypto choices expiry notional worth to round $3.3 billion.

Crypto Market Outlook

Crypto markets are again within the pink this Friday with a 3.7% hunch in complete capitalization, which has fallen to $2.76 trillion.

Bitcoin fell again to $80,000 earlier than making a minor restoration to succeed in $82,000 through the Friday morning Asian session. Nevertheless, the asset stays weak, and analysts have predicted a fall to $70,000 in a deeper correction.

Ethereum stays at bear market ranges, with costs failing to high $1,900 following a fall to $1,830.

The altcoins are usually blended with bigger losses for Cardano (ADA), Pi Community (PI), and Hedera (HBAR) and minor positive factors for XRP, Binance Coin (BNB), Tron (TRX), and Stellar (XLM).

The submit Will Crypto Markets React to $3B Bitcoin Choices Expiring At present? appeared first on CryptoPotato.