Bitcoin is at present testing an important help zone on the 200-day transferring common ($83K) and the 0.5 Fibonacci retracement stage. The value motion close to this vary is important and decisive for the market, as a bearish breakdown might set off a serious sell-off.

Technical Evaluation

By Shayan

The Day by day Chart

Bitcoin’s value has discovered help on the 200-day MA ($83K), resulting in a sideways consolidation. This help zone aligns with the 0.5-0.618 Fibonacci retracement vary, reinforcing its significance. A break beneath this stage might sign a pattern shift towards a bearish market, whereas holding above it might provoke a bullish rebound.

For now, Bitcoin is trapped between the 100-day ($95K) and 200-day MAs ($83K). Till a decisive breakout happens, consolidation inside this vary is essentially the most possible state of affairs for the quick time period.

The 4-Hour Chart

On the decrease timeframe, Bitcoin broke beneath its ascending channel, adopted by a retracement to the damaged help, a basic bearish affirmation.

This sample suggests additional draw back threat if the cryptocurrency breaks beneath the wedge’s decrease boundary, probably pushing the worth beneath $80K.

Nonetheless, the 0.5-0.618 Fibonacci vary stays a powerful help zone, growing the chance of a mid-term bullish reversal. Given the unsure value motion, Bitcoin is anticipated to consolidate between $80K-$95K within the quick time period till a breakout determines the following main pattern.

On-chain Evaluation

By Shayan

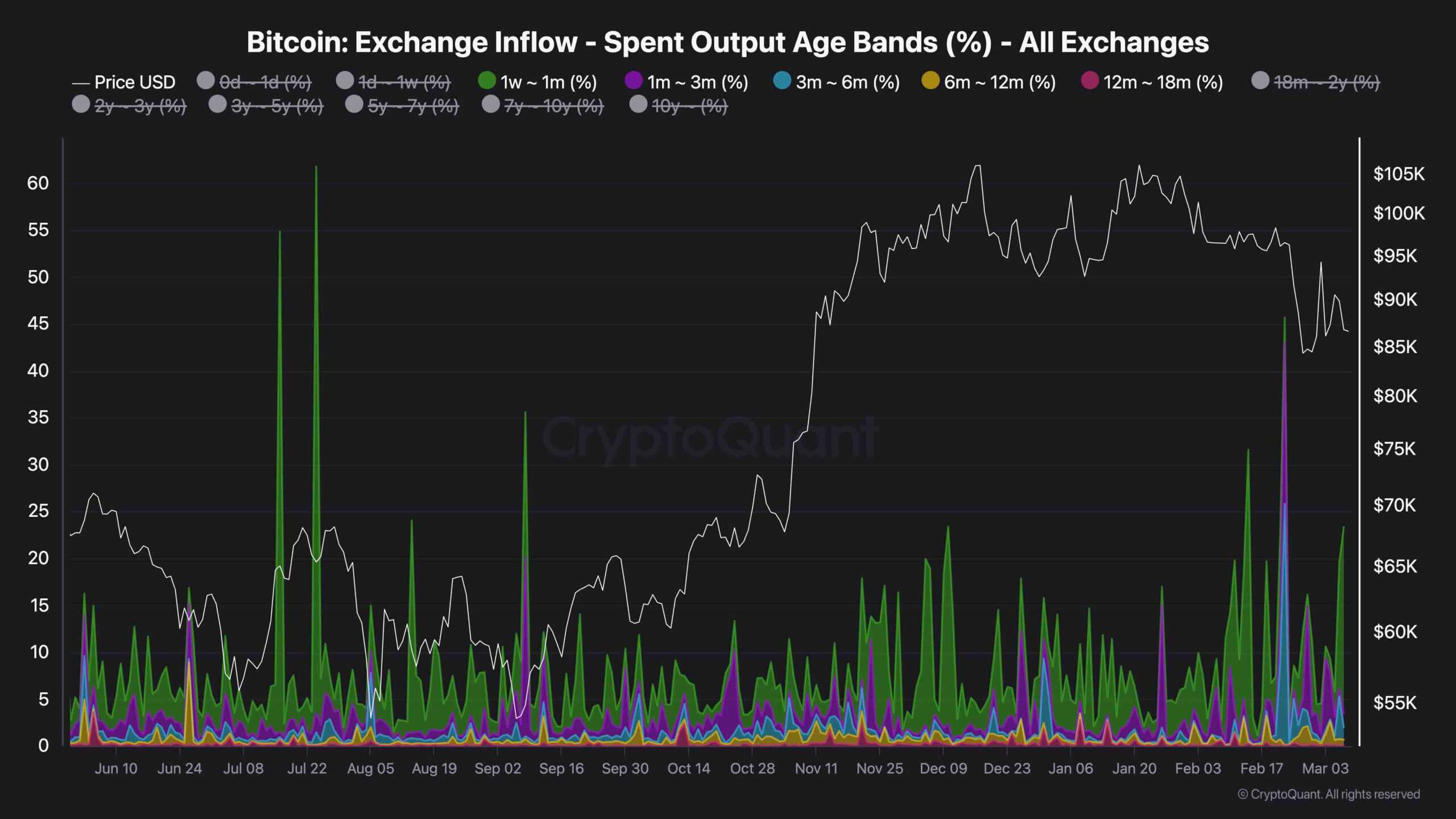

Whereas Bitcoin’s bullish momentum seems to be fading, analyzing investor habits supplies key insights into market sentiment. One helpful metric on this regard is the Spent Output Age Bands of change inflows, which measures the proportion of deposited BTC based mostly on how lengthy buyers have held their cash.

Inspecting the 1-week to 6-month age band, current sell-offs have been primarily pushed by short-term holders, buyers who usually react rapidly to cost swings. This implies that panic promoting and profit-taking amongst these merchants have contributed to the worth retracement.

However, long-term buyers (holding for over 6 months) present no indicators of aggressive promoting stress. As a substitute, their exercise aligns with gradual profit-taking, a attribute of any wholesome bullish pattern.

This means that these buyers count on increased costs earlier than distributing, lowering instant provide available in the market. If adequate demand enters the market, this provide shrinkage might gas additional value appreciation.

The publish Bitcoin Value Evaluation: Is BTC Due for an Imminent Crash to $80K This Week? appeared first on CryptoPotato.