Round 29,000 Bitcoin choices contracts will expire on Friday, March. 7, and so they have a notional worth of roughly $2.5 billion.

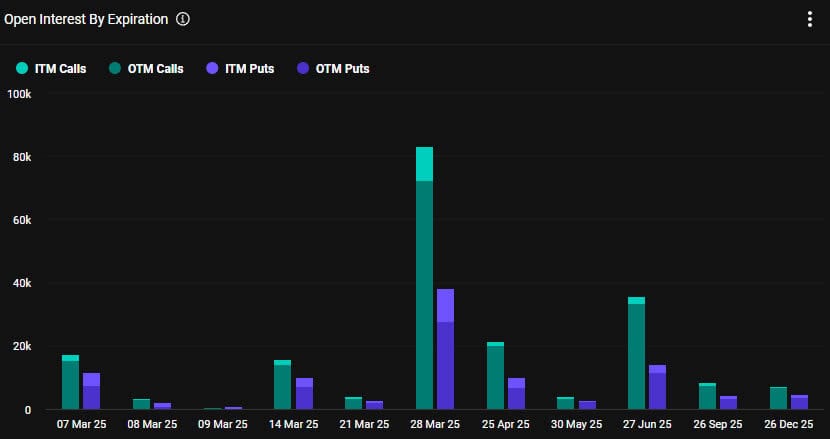

This week’s occasion is way smaller than final week’s end-of-month expiry, however a mammoth end-of-quarter contract expiry is due on March 28.

The impression on spot markets is more likely to be minimal as all eyes are on the White Home crypto summit, additionally going down right now.

Bitcoin Choices Expiry

This week’s tranche of Bitcoin choices contracts has a put/name ratio of 0.67, that means that there are barely extra name (lengthy) contracts expiring than places (shorts).

Furthermore, open curiosity (OI), or the worth or variety of BTC choices contracts but to run out, stays excessive on the $120,000 strike value, which is $1.4 billion, based on Deribit.

There’s additionally over $1 billion in OI on the $100,000 and $110,000 strike costs. Bearish sentiment can also be seeping again as $750,000 in OI presently sits on the $80,000 and $70,000 strike costs.

Crypto derivatives supplier Greeks Reside stated the group was nonetheless “predominantly bearish,” including that merchants have been “anticipating additional draw back whereas experiencing frustration with excessive chop and volatility.”

It added that almost all merchants have been watching the $87k to $89k vary as key resistance, with $82k famous as a current backside, “although there’s important disagreement on whether or not a sustainable backside has been discovered.”

“Market experiencing excessive value swings with Bitcoin shifting $6k in a day, creating what merchants describe as ‘rip-off each methods’ value motion.”

Round 223,000 Ethereum contracts are additionally expiring right now, with a notional worth of $482 million and a put/name ratio of 0.71. This brings Friday’s mixed crypto choices expiry notional worth to round $3 billion.

“Trump tariff bulletins (and subsequent reversals) are contributing to market confusion, with many merchants sitting out on account of unpredictable value motion,” Greeks concluded.

Spot Market Tanks

Markets have been extraordinarily risky over the previous 24 hours, with complete capitalization dumping round $200 billion following Donald Trump’s govt order for a strategic Bitcoin Reserve.

Bitcoin tanked virtually 6%, falling from above $90,000 to $85,000 in lower than an hour earlier than it bounced off to $88,000. The response got here as White Home crypto czar David Sacks stated the reserve could be capitalized by BTC already seized by the US authorities.

Retail took this to imply the US wouldn’t be shopping for any extra BTC for its SBR and dumped the asset. Nonetheless, the small print states that the Treasury and Commerce secretaries have been directed by Trump to seek out “funds impartial” methods to accumulate BTC.

Nonetheless, crypto markets stay within the pink this Friday morning.

The submit What’s Subsequent for Markets as $3 Billion in Crypto Choices Expire At present? appeared first on CryptoPotato.