Following a rejection on the essential 100-day transferring common, Ethereum skilled an impulsive decline, reaching the essential $2K assist. Nonetheless, the value has bounced again and goes by a relatively muted worth motion, indicating a possible consolidation stage.

ETH Value Evaluation: Technical Evaluation

By Shayan

The Each day Chart

Ethereum confronted heavy promoting strain on the 100-day transferring common of $3K, resulting in an impulsive decline towards the $2K psychological assist. Regardless of this bearish transfer, the value rapidly rebounded, clearing over-leveraged lengthy positions within the futures market.

The cryptocurrency is now buying and selling between $2.5K (assist) and $3K (resistance), forming a decisive vary.

A breakout from this vary will present clear affirmation of the following main development. Nonetheless, short-term consolidation stays essentially the most possible situation.

The 4-Hour Chart

On the decrease timeframe, ETH initially broke above the descending wedge sample, however the breakout proved false, resulting in a pointy decline towards the $2.2K assist vary.

This transfer triggered the sell-side liquidity earlier than the value rebounded strongly. Now, the cryptocurrency is going through a robust barrier on the 0.5-0.618 Fibonacci retracement zone and the $2.8K resistance degree.

Whereas a interval of excessive volatility is anticipated within the close to time period, there’s additionally a risk that the sellers would possibly regain management of this resistance zone, inflicting one other rejection towards the $2K threshold.

Onchain Evaluation

By Shayan

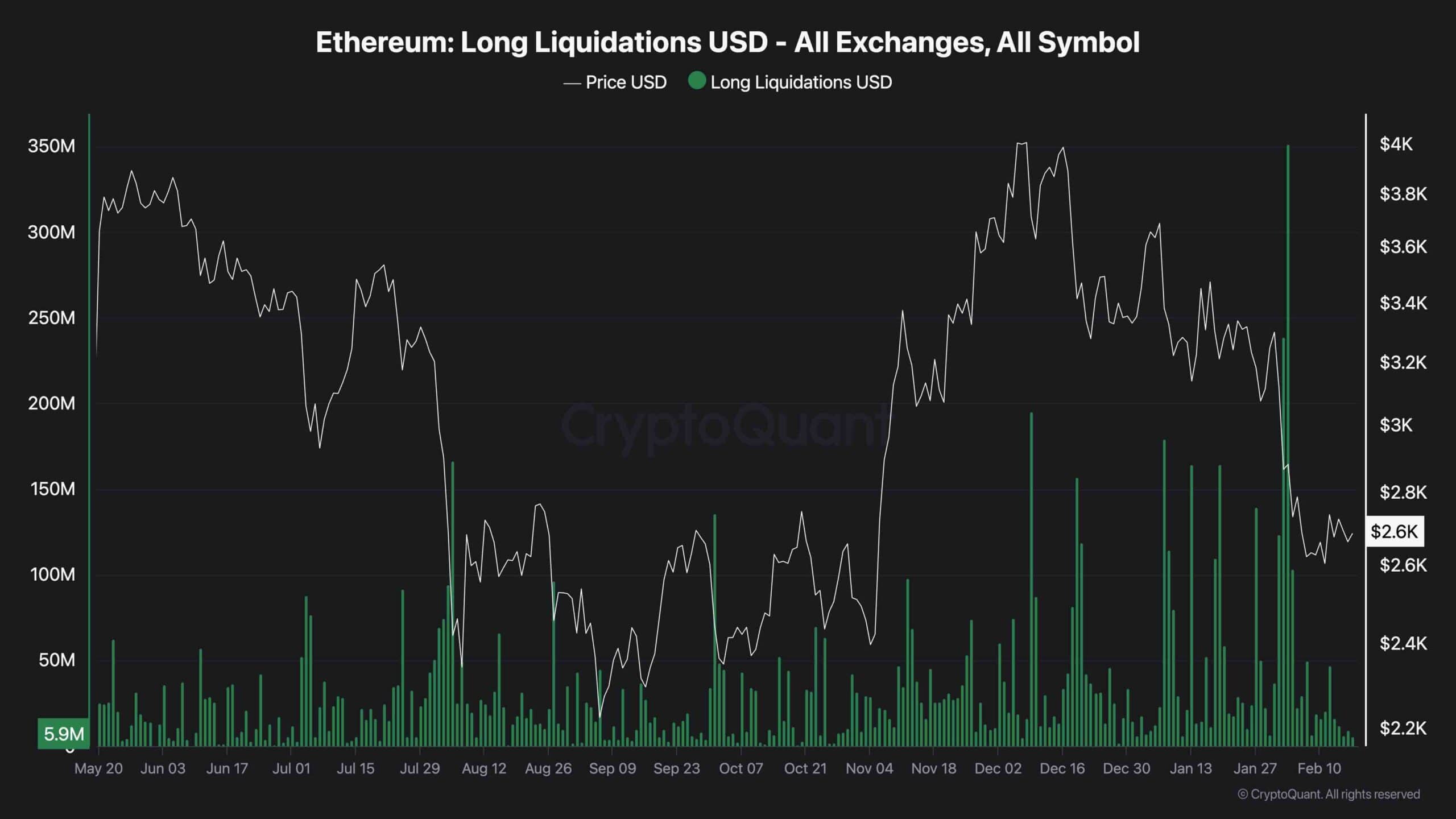

Ethereum just lately confronted a dramatic market decline, resulting in an extended squeeze that worn out a big variety of leveraged lengthy positions, as proven within the chart. This occasion prompted heightened volatility, however regardless of the sharp drop, the cryptocurrency managed to seek out robust assist on the $2K degree, indicating potential stabilization.

The current liquidations have cooled the perpetual markets down, decreasing extra leverage in doing so. This reset may pave the best way for brand new demand, as cautious patrons step in at key assist zones.

If Ethereum maintains above $2K and builds momentum, the present consolidation section may transition right into a recent bullish wave, with $2.5K and $3K as key resistance ranges. Brief-term consolidation stays probably, however a breakout above these resistance ranges may sign the following main development transfer.

The submit Ethereum Value Evaluation: $2200 or $3000, Which Comes First for ETH? appeared first on CryptoPotato.